Here’s a list of this week’s best investing news:

Innovations in Asset Management (Investor Amnesia)

Emerging Markets Crisis Investing (Verdad)

12 Life Lessons From Mathematician and Philosopher Gian-Carlo Rota (Farnam Street)

Hammers and Nails (Epsilon Theory)

Howard Marks: The Biggest Risk Is Rising Interest Rates (Market NZZ)

Investing legend Terry Smith’s $30 billion equity fund returned 440% to investors over a decade (Business Insider)

Rich Pzena: Value Is Not A Factor But Philosophy (Pzena)

The Price-Value Feedback Loop: A Look at GME and AMC! (Aswath Damodaran)

Clipper Fund: Annual Review 2021 (Clipper)

Mistakes and Memes (Stratechery)

Stop Stressing About Inflation (Barry Ritholz)

A value premium update for the not very interested (EB Investor)

Say No to FOMO (Humble Dollar)

Jeremy Grantham: Reinvesting when Terrified (GMO)

Overhauling Twitter (Scott Galloway)

How to Temper a Momentum Strategy (Morningstar)

The Stock Market Pendulum (Novel Investor)

Animating Mr Market (Credit Suisse)

My Bet with Buffett – Year Three Results (DGI)

Best Story Wins (Collaborative Fund)

Renaissance Hit With $5 Billion in Redemptions Since Dec. 1 (Bloomberg)

Is This 1929 or 1998? (Compound Advisors)

No, Wall Street Is Not Rigged (Morningstar)

Angry customers show up at Robinhood’s headquarters in the wake of GameStop trading chaos (CNBC)

From Tiny Bubbles To Frothy McBubbles (Howard Lindzon)

Say It With Me: Dividends Suck (Whitney Tilson)

It is Difficult Being a Skilful Investor (Behavioural Investment)

From Discovery To Coke: Companies Taking The Long-Term View To Create Shareholder Value (Boyar)

Random Investing in High Tech Stocks (PAL)

New Data On Retail Investment (UPFINA)

Dan Loeb: Fourth Quarter 2020 Investor Letter (Third Point)

The Price of Nature (CFA Institute)

Breakin’…The Movie & The Yield Curve (As In, The Yield Curve Is Breakin’ Out) (Brinker)

The Pirate Problem (Alex Danco)

A Beginner’s Guide To Generating Passive Income from Bonds (Sure Dividend)

One Easy Way to Improve Your Judgment (Musing Zebra)

A Strange Cycle for Cyclical Stocks (The Diff)

Inflation Is Up for Discussion (Dr Ed)

The Transcript 02.08.21 (Transcript)

This week’s best value investing news:

Large-Cap Value Stocks Could Be Long-Term Winners (Barron’s)

Market Outlook 2021: Global Equities and Value Investing (Schroders)

Nir Kaissar on the Value Rebound: When Not If (Validea)

Growth Vs. Value: A Practical Perspective (Value Stock Geek)

How One Value Manager Survived the 13-Year Bear Market (Institutional Investor)

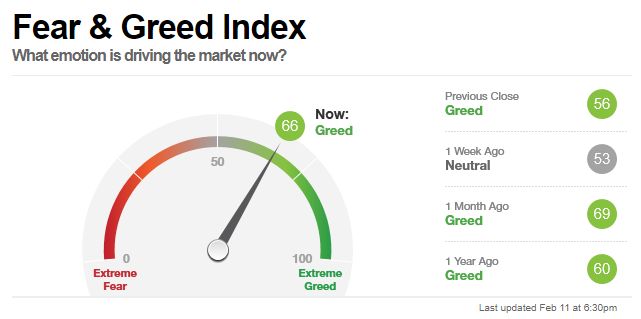

This week’s Fear & Greed Index reading:

This week’s best investing research:

Will the Real Value Factor Funds Please Stand Up? (Alpha Architect)

The Rationale for Investing in Exotic Alternative Investments Today (AllAboutAlpha)

Ready For 4 Percent CPI By Mid-Year? (GMM)

This week’s best investing tweet:

This week’s best investing podcasts:

TIP335: Mastermind Q1 2021 w/ Tobias Carlisle and Hari Ramachandra (TIP)

Ron Baron on Investing in Tesla and SpaceX (Bloomberg)

The MicroCap Advantage by Ian Cassel (MicroCap)

#103 Loch Kelly: Effortless Mindfulness (Knowledge Project)

Grant Williams On Focusing On What’s Important (Felder)

Build Focused Portfolios That Beat The Market: Dreifus (WealthTrack)

A Detailed Look at Joel Greenblatt’s Magic Formula Method (Excess Returns)

Bonus: Andrew Walker – A SPACtacular Conversation (Business Brew)

#114: The GOAT: Jeff Bezos Retires as Amazon CEO (Absolute Returns)

MacroVoices #256 Russell Napier: Prepare for Secular Inflation (Macro Voices)

2021 Outlook for Value (Pzena)

Anthony Deden, Edelweiss Holdings – Preview (Grant Williams)

Note Taking, Cloning, and Idol Worship | A Market in Replacement Capital (Intelligent Investing)

The Experience Factor (Barron’s)

Michael Dempsey – Investing in Bleeding Edge Technology (Invest Like the Best)

This week’s best investing graphic:

How To Spot Fake News (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: