In his latest webinar titled – The Beginning Of The Great Rotation To Value?, Rich Pzena provides his thesis on why we could be at the beginning of another great rotation to value, based on historical indicators. Here’s an excerpt from the webinar:

Pzena: This is really a perfect time to ponder the question that has been asked of us time and time again. Is this it? Are we starting the long-awaited cycle for value investing?

It’s an exciting time no doubt. The fourth quarter was one of the periods of time that we all dream of as value investors. When we all get excited that okay maybe finally after 10 years of waiting we’re ready to start a cycle that recognizes valuation.

First and foremost I’m a research analyst and so I tend to look at data to try and understand and draw some conclusions about whether you can even make that call. And while history is not necessarily a perfect predictor of the future it is certainly worth studying.

So I wanted to… we’ve been talking for the last, oh I don’t know a couple of years, about what would you be looking for to see what are the possible catalysts that could say here we are this is the cycle, and we’ve identified a few of them, but first and foremost is the start of a recession.

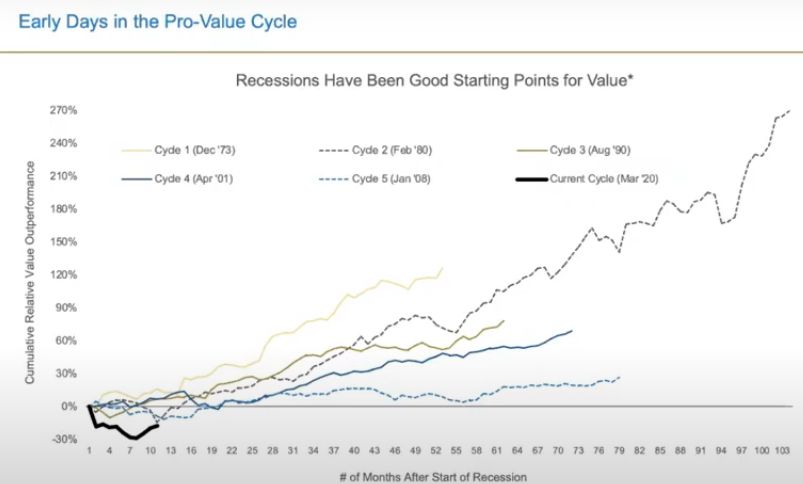

If you look backwards over history the last nine recessions in a row have all coincided with a great value cycle. We’re showing the last five on this chart in front of you…

And actually if you go back as far back as you can find data, the last hundred years where there have been fourteen recessions, in twelve of them value outperformed the broad market if you date it back to the beginning of the cycle. What you see here is measured on the x-axis are the five prior cycles and then the current cycle in the dark black line where time zero is the day the recession began.

In this case when covid hit and we measure that back to April, and then you can see how value has done historically over the ensuing years up until the point when the value cycle ended. So what can you conclude from this?

Well generally speaking post-recession or during the beginning in a recession value starts to outperform, and that outperformance extends for a reasonably long period of time.

Now we have to be realistic in understanding why the outperformance happens. It happens because the performance before the recession was so bad and the valuations as we get towards the recession and then the early stages of recession get compellingly cheap.

Companies then take action to adjust their operations to the reality of the economic environment that they’re facing. This is no different. This happens to be a very severe one, one that we’ve never experienced as an investment team.

But nevertheless the companies respond and by responding they restructure, cut costs, they change things to try and cope with the realities of the economic downturn and then as things start to get better in the downturn something interesting happens.

The value stocks become the momentum stocks. In fact in every single one of these cycles in the periods initially, during, and early into recession, value and momentum are the same.

You can listen to the entire webinar here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: