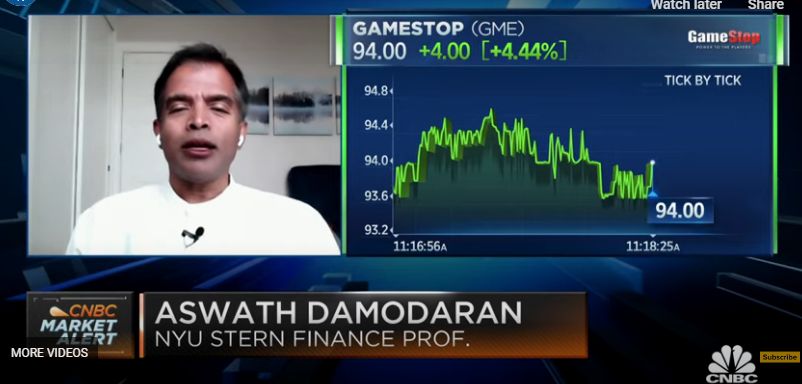

In his latest interview on CNBC, Aswath Damodaran provides a warning to investors who may be considering joining the ‘If you can’t beat them, join them crowd’. Here’s an excerpt from the interview:

Question: More broadly Cuban’s point, and I’m sure he’ll accuse me of oversimplifying, but I think his general point was that equities at this point are a tool to trade or for yield and that there’s really no interest in equity owners in looking at true fundamentals. He thinks that might be an outdated way of looking at that asset class. What do you think?

Damodaran: Well markets have always been a mix of traders, people who care about price and what happens to price, and people who care about value, and each group needs the other.

So value investors need traders to provide liquidity, traders need value investors to provide a sense of balance, and I think markets get into trouble when one group gets much too large.

So Mark’s point is right. This is a market driven by traders. On any given day we try to explain what happens to the price of any stock, it’s more to do with mood and momentum. In the case of GameStop, revenge, than it has to be with fundamentals.

But there’s an underlying reality that none of us can run away from which is these are shares of companies and businesses, and ultimately if the numbers are not there the earnings and the cash flows perception alone can’t keep the price of whatever you want it to be. So that is I think the reality we cannot lose sight of.

Question: So you don’t think it’s a matter of if you can’t beat them join them?

Damodaran: Well you can join them with the caveat which is you need to know when to get off this elevator. Because momentum works until it doesn’t. The people who make money in momentum are the people who can detect when momentum shifts.

So if you want to be a trader, be a trader, but be aware of the fact that you’ve got to sense when the momentum is shifting. That’s a very different game. If you’re good at it you can make a lot of money but if you’re not I mean you’re going to get slaughtered!

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: