In their latest market outlook, Broyhill discusses the unprecedented dispersion between the ‘haves’ and the ‘have-nots’, notable examples of current market madness, and why value could be set for sweet revenge. Here’s an excerpt from the commentary:

Word of an effective vaccine sent the world’s cheapest stocks surging the most on record relative to their faster growing peers, as investors rotated out of expensive COVID beneficiaries and into depressed shares poised to gain from a COVID recovery. Global value stocks jumped almost 6% while their growth counterparts fell 2% over the two days.

Last week’s move in value stocks was extreme on many metrics. But not nearly as extreme as the move in growth stocks over the last decade, which is perhaps the best run for growth (and the worst for value) in a century. Stepping back to look at the full picture, we see how much room value has to run. Don’t look now, but we may have just turned the corner.

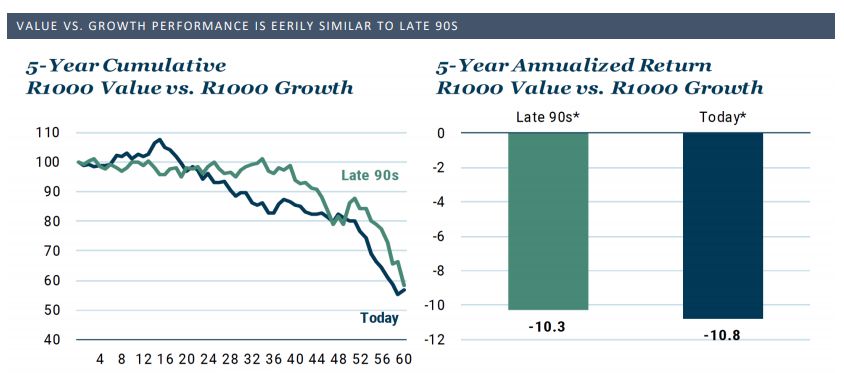

In the late 90s, value was out of style and on the defensive. Well-known value investors were closing shop and headlines proclaimed the Death of Value. Two decades later, the similarities are striking. The underperformance of value relative to growth over the last five years is almost identical to the five years ending February 2000. As such, it may be constructive to examine that period for signs of what’s to come.

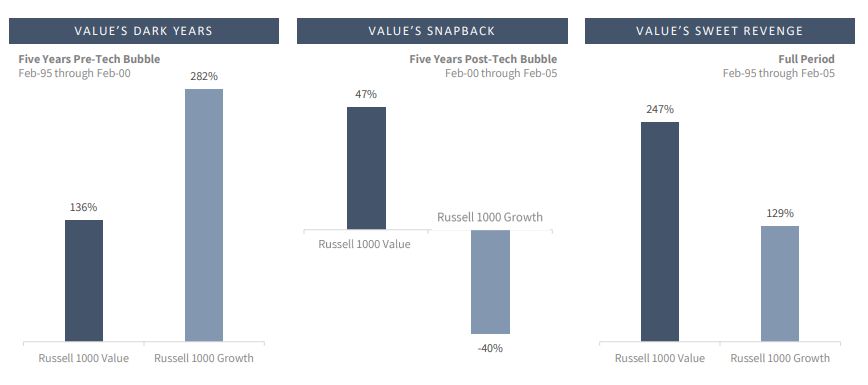

Mean reversion is perhaps the most powerful force in finance. After underperforming by nearly 150% in the five years prior to the tech bubble’s peak, value went on to trounce growth as the bubble deflated. Despite the early pain, patient investors were ultimately rewarded for their perseverance – value outperformed over the full period by a wide margin. As it turns out, the price you pay matters. A lesson today’s growth investors may need to relearn.

You can read the entire market outlook here:

You can read the entire market outlook here:

Broyhill Market Outlook December 2020

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: