Here’s a list of this week’s best investing reads:

The Great Equalizer (Verdad)

Oh No, Here It Comes Again, That Funny Feeling (Epsilon Theory)

Descriptions Aren’t Prescriptions (Farnam Street)

Tobias Carlisle – Diamonds In The Rough (Premium) (Real Vision)

Making an Impact (Jamie Catherwood)

Who Owns the Stock Market? (Irrelevant Investor)

‘Our Recent Performance Sucks.’ Here’s Your $10 Billion Back (WSJ)

Worst Case Scenarios (The Reformed Broker)

What’s Going to Happen to All the Underfunded Pensions? (A Wealth of Common Sense)

I Have A Few Questions (Collaborative Fund)

Have Investors Gotten Too Bearish On The Banks? (Felder Report)

We’re All Guinea Pigs For Tesla’s R&D (Axios)

Software Is Eating The Markets (Not Boring)

Charlie Munger’s ‘Bag of Tricks’ (Investment Masters Class)

Best Investing Podcasts 2020 + Best Value Investing Podcast (TIP)

Payments, Processors & Fintech (Credit Suisse)

The Wit and Wisdom of Warren Buffett (DGS)

Value in Recessions and Recoveries (Research Affiliates)

Was That Intentional? Ways to Improve Your Active Risk (AQR)

The ‘Melt Up’ Is Here… Don’t Miss Out (Whitney Tilson)

Twitter, Responsibility, and Accountability (Stratechery)

Weekly Earnings Calls 11.26.20 (The Transcript)

Christian Billinger: In Defence of Cognitive Biases (MOI)

Fall 2020 Edition of Graham & Doddsville (G & D)

Look Under the Hood (Humble Dollar)

Life & Death (Scott Galloway)

Lesson in Valuation from a 2200-Year-Old Greek Mathematician (Safal Niveshak)

Howard Marks’ Warning to Investors (Investment U)

Examining “Ben Graham’s Net Nets: Seventy-Five Years Old and Outperforming” (GII)

Low Interest Rates and Risk Taking (Brian Langis)

Three Things I Think I Think – Grossly Rich Edition (Prag Cap)

Sustainability & A Kick Ass Culture (Greenwood)

Investments In The Intangible Economy (Sparkline Capital)

Framework for Decision-Making in a Time of Change (Andreessen Horowitz)

What is the Attraction of Star Fund Managers? (Behavioural Investment)

This week’s best value investing reads:

AQR’s Asness Joins Star Managers to Plead the Case for Value (Bloomberg)

Combining Value and Profitability Factors to Improve Performance (Alpha Architect)

Value Investing Series, Part 1, Part 2, Part 3 (Aswath Damodaran)

Value Investing Waves the White Flag Again (Aleph)

Covid condemns value investing to worst run in two centuries (FT)

This week’s best investing research reads:

Myths of Private Equity Performance: Part I (CFA Institute)

CAPE and the COVID-19 Pandemic Effect (Robert Shiller)

The Probability Theory in Finance and Radical Uncertainty (Validea)

Not all Gold Shines in Crisis Times (QuantPedia)

Cash for gold? Tread carefully (EB Investor)

How Can I Make the Most of My Stock Options? (Schwab)

To Realize, or Not to RealizeCapital Gains Tax and Portfolio Choice (Elm)

The Alternative Imperative, Part II (All About Alpha)

The 2020 US elections and the markets: what can history tell us? (Meketa)

Trend-following strategy as the new safe haven asset (DSGMV)

Price, Value and Sources of Returns (DGI)

This week’s best investing podcasts:

Value Investing Live: Tom Russo (GuruFocus)

The Worst Chart in Finance (Animal Spirits)

#95 Code Cubitt: Coachability Is Critical (Knowledge Project)

The Dangers of Trying to Outsmart the Market (Excess Returns)

100x: Lessons From Analyzing Past 100-Bagger Stocks (Focused Compounding)

Ray Dalio on the Decline of Real Interest Rates (MIB)

Ep. 145 – Private Company Valuation Methodology for Public Securities with Keith Smith, Portfolio Manager at Bonhoeffer Capital (Planet MicroCap)

Why Hedge Fund Billionaires Got Bearish (The Compound)

How Investors Should Deal With The Overwhelming Problem Of Understanding The World Economy – Ep 99 (Intellectual Investor)

Brad Gerstner and Rich Barton – Thriving in Changing Markets (Invest Like the Best)

TIP320: Negotiations w/ Former FBI Agent Chris Voss (TIP)

Deep Value Opportunities (WealthTrack)

Unstoppable Automation Trend | Value Traps and IBM | Index Data Insights (Intelligent Investing)

Episode 16: David M. Rubenstein (Boyar)

Will Thrower: Deep Value Opportunities in Japan & Australia (Ep. 47) (Macro Ops)

Chamath Palihapitiya Joins My Zoom Show ‘Investing For Profit and Joy’ (Howard Lindzon)

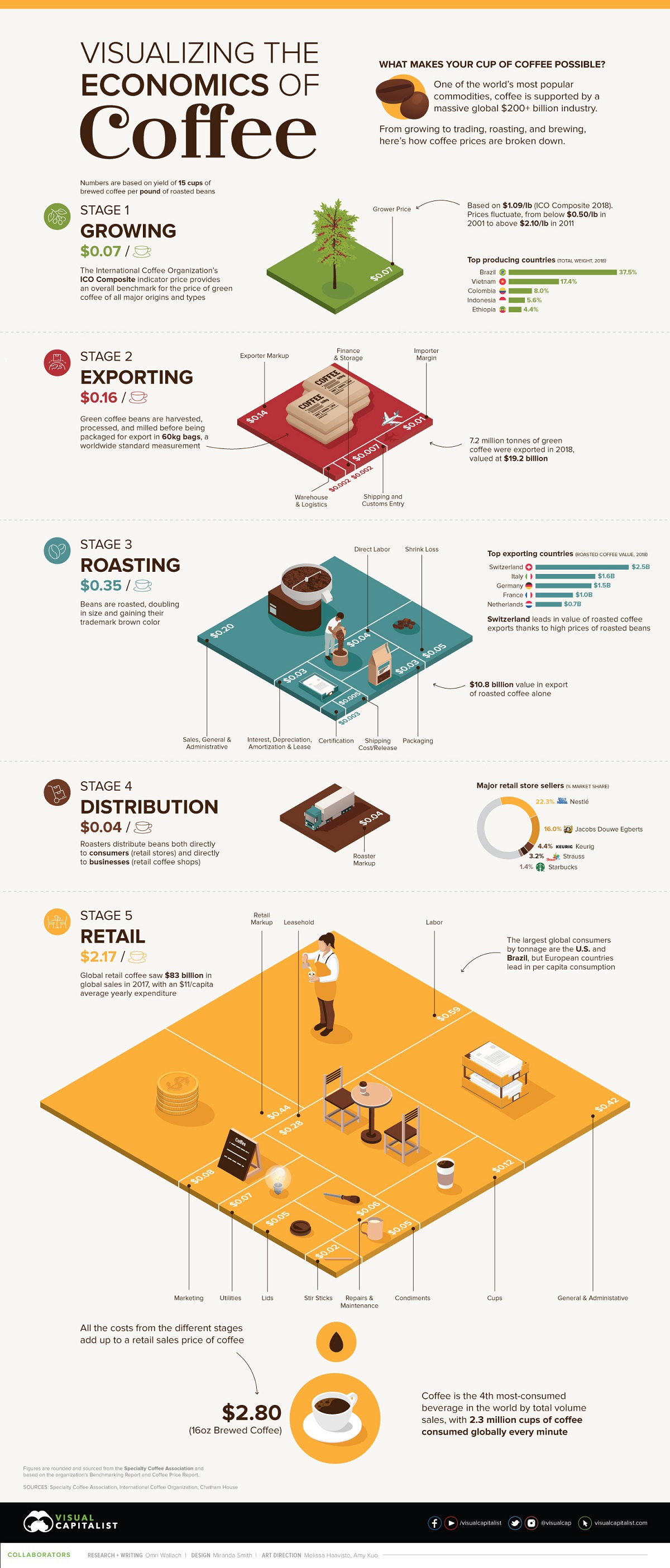

This week’s best investing graphic:

The Economics of Coffee in One Chart (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: