Here’s a list of this week’s best investing reads:

Gambling, Lies & Markets (Jamie Catherwood)

The Path Not Taken (Humble Dollar)

Being Smart is Not Enough (Farnam Street)

The opposite of stimulus (Reformed Broker)

Sales and Distributions (Verdad)

Hook, Line and Sinker (Epsilon Theory)

Luck and Success (The Irrelevant Investor)

Common Causes of Very Bad Decisions (Collaborative Fund)

Inflation Could Reach 10%, Says Druckenmiller (Validea)

No, This Isn’t a Repeat of the Dot-Com Bubble (Of Dollars and Data)

GOGO Strategic Alternatives (Non-GAAP)

Mistakes Have Been Made & Lessons Have Been Learned (Value Stock Geek)

Warren Buffett was blasted as ‘washed up’ for not buying during the coronavirus crash. Berkshire Hathaway has announced $19 billion of investments this quarter (Business Insider)

It’s Time To Get Greedy In The Energy Sector, Part Deux (Felder Report)

Unleash the Mouse (Scott Galloway)

Letter from the Value Investing Mental Asylum or How I Embraced Stoics (Vitaliy Katsenelson)

Proving The Bears Wrong (MacroTourist)

Mario Gabelli on the market (CNBC)

Warren Buffett’s charity dinner spurred the boss of an online-trading platform to embrace value investing (Business Insider)

Beware of Stockbrokers (Safal Niveshak)

Contrarian Money Manager Didn’t Always Bet Against Crowd (WSJ)

JPM – Guide to the Markets -Q4 2020 (JPM)

Weekly Earnings Calls 09.28.20 (The Transcript)

This Preferred From a John Malone-Controlled Company Offers an 8% Yield (Barron’s)

No one sees their own blind spots (EB Investor)

Last Day to Provide SEC Feedback on 13F Proposal (Market Folly)

Why the Worst Companies Lost Big and How to Avoid Them (Novel Investor)

Your diversification free lunch is not “all you can eat” (Nucleus)

Is Exxon the Next General Electric? (A Wealth of Common Sense)

Five Hacks for Making Better Investment Decisions (Fundoo Professor)

Buying Money Losers Makes Sense? (UPFINA)

Tudor’s 10-Rules To Navigate Q4-2020 (Advisor Perspectives)

The light at the end of the tunnel is very faint (Klement)

Sustainability & The Ultimate Intangible (Greenwood)

The Investing Question of a Lifetime (Investment U)

Think Like a Poker Player (Real Returns)

The Nifty Fifty: Valuing Growth Stocks (DGI)

What the ‘K Shaped’ Economy Means for Your Financial Future (Whitney Tilson)

Reflecting At The Milestones: Implementing the Partial Kelly Strategy (Breaking The Market)

Monopolies Are Distorting the Stock Market (Sparkline Capital)

Radical Uncertainty in Finance: The Origins of Probability Theory (CFA Institute)

The Deficit Myth (Barel Karsan)

Ins and Outs of Emerging Markets Investing: Market Behavior and Evolution (Dimensional Fund Advisors)

This week’s best value investing reads:

Value Stocks Are Outperforming Growth—at Least for Now (WSJ)

7 reasons why investors should favour value stocks over growth, according to BofA (Business Insider)

Will value survive its long winter? (Robeco)

This week’s best investing research reads:

Does Financial Leverage Make Stocks Riskier? (FactorResearch)

Has Your Market Analysis Gone to the Dogs? (All Start Charts)

S&P500 Key Levels (GMM)

“Buying the Dips” Hits New Record (PAL)

An Inconvenient Fact: Private Equity Returns & The Billionaire Factory (SSRN)

Benford’s Law Suggests Bitcoin’s Price Manipulation (QuantPedia)

Lottery Preferences and Their Relationship with Factor Investing (Alpha Architect)

How Does The Distribution of Outcomes Affect Our Investing Decisions (Good Investors)

Decoding Systematic Relative Investing: A Pairs Approach (Research Affiliates)

Tail events – Historical, Implied and Subjective Distributions (DSGMV)

This week’s best investing podcasts:

Worst Recession Ever (Animal Spirits)

Jonathan Boyar on Value Investing Live (Boyar)

#93 Matt Holland: Zero Day (Knowledge Project)

285- Allan Mecham’s Investing Philosophies (InvestED)

Rahul Vohra – Using Emotion to Design Great Products (Invest Like The Best)

Dave Portnoy on the Business of Sports Media (MIB)

Interview: The Past, Present and Future of Investing with John Rekenthaler (Excess Returns)

#89: Deals Deals Deals! SPACs Spend While Berkshire Bites (Absolute Returns)

How To Make A Hundred Million Dollars For No Reason: What Are Your Thoughts? (The Compound)

Dirty Harry of the Oil Market (guest: Tracy Shuchart aka @chigrl) (Market Huddle)

$UBER Deep Dive w/ Abdullah, Mostly Borrowed Ideas (Episode 44) (Value Hive)

TIP316: Current Market Conditions w/ Preston & Stig (TIP)

Buffett’s ‘Elephant Gun’ (What Goes Up)

Ram Parameswaran: The Investment Philosophy of an Internet Investor (MOI Global)

The Interview – Larry McDonald: “The Cobra Effect” (Real Vision)

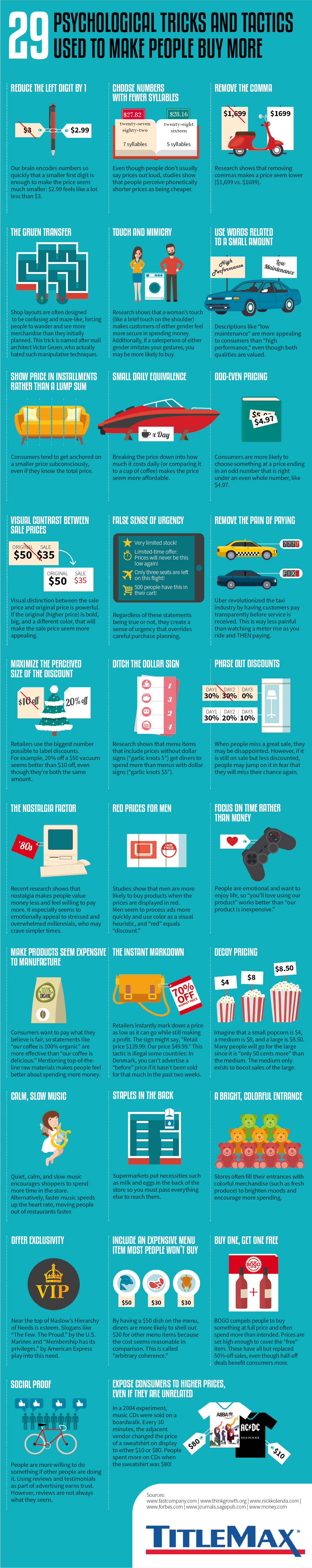

This week’s best investing graphic:

29 Psychological Tricks To Make You Buy More (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: