The latest article from Miller Value Partners titled – Don’t Forget Value – makes a very strong case for a comeback in very attractive long-term returns for value investors based on the history of valuation spreads. Here’s an excerpt from the article:

In our last quarterly letter, we highlighted a piece from Empirical Research Partners that focused on the extreme dispersion of current valuation spreads versus history. Valuation spreads have only been this wide on two other time periods in the past 70 years: 1973-74 and 1999-2000.

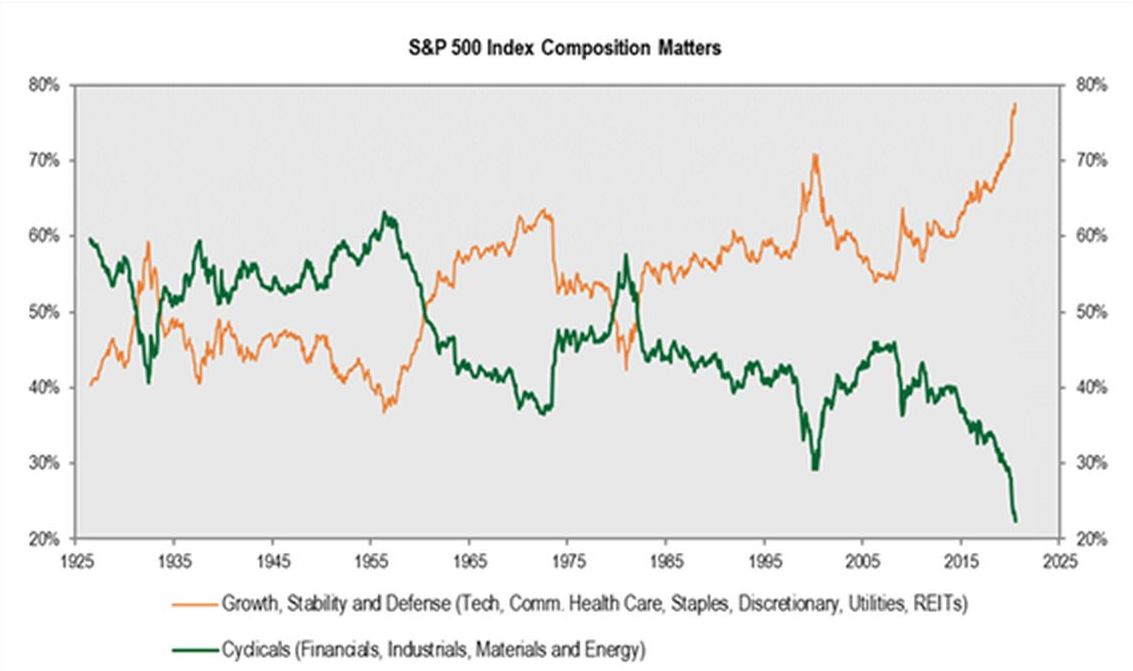

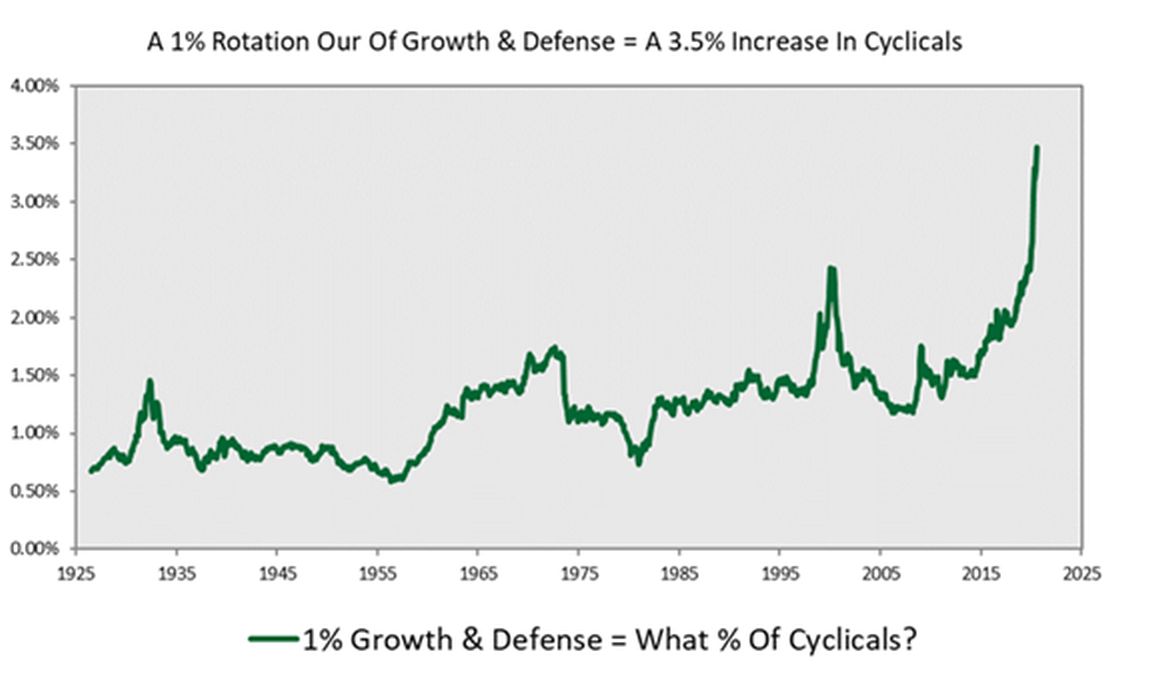

A closer look also shows that the historical time periods of wide valuation spreads coincides with prior troughs for cyclical sector representation in the S&P 500. This is not surprising, as the market fears on cyclical portions of the market are very high at the beginning of a recession. However, history has shown that the eventual reallocation from Growth & Defense areas of the marketplace can be significant near its extremes. As the chart below highlights, a 1% rotation today equals a 3.5% increase in Cyclicals, nearly 50% higher than 2000 and twice 1974 levels.

(Source: Cornerstone Macro)

At the extremes, it’s always difficult to know what could be the catalyst to change market perceptions. History would suggest there are numerous ways for the current extreme valuation spreads to narrow over time. If the economic growth slowdown persists, it may potentially dampen growth for all market participants, which could cause a potential rerating of higher valuation and low volatility equities that are discounting levels of earnings stability and higher future growth.

However, the record stimulus that is currently helping to stabilize global economies could also lead to an even greater recovery in economic growth over the coming 12 to 18 months as COVID-19 fears subside. As the marketplace is forward looking, it may begin to narrow the significant price-to-value divergence in lower valuation companies (cyclicals) with attractive long-term business value supported by higher future normalized earnings and free cash flow. We would also highlight the significant amount of liquidity that has been building up on corporate balance sheets and within private equity. As the economy continues to improve, these market participants may begin to also recognize the significant value in lower valuation securities.

History has shown, these time periods with wide valuation spreads are usually followed by very attractive long-term returns for Value. Post the 2000 peak, Value generated very attractive absolute returns that significantly outperformed the overall market. Today, low valuation securities are at similar absolute levels to 2000 and even wider valuation spreads to the more expensive portion of the market. It makes one wonder when perceptions change if the embedded return potential could be even greater over the next couple of years.

You can read the entire article here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: