Here’s a list of this week’s best investing reads:

Why We Don’t Learn From History (A Wealth of Common Sense)

The Art of Being Alone (Farnam Street)

News, Media, & Markets (Jamie Catherwood)

On the link between economic inequality and social injustice (The Reformed Broker)

Why The Stock Market Could Be Poised For Another Plunge (The Felder Report)

How to Play a Value Stock Rebound (Validea)

Should You Let Your Stocks Ride? (Morningstar)

Tail Risk Hedging (Verdad)

Delisting China Stocks? (Brian Langis)

Grantham’s GMO slashes exposure to ‘one-sided’ US stock market (FT)

+38% From the Low (Crossing Wall Street)

Post Corona: Higher Ed, Part Deux (Scott Galloway)

The Unusual Ambitions of Chamath Palihapitiya (Institutional Investor)

Why Losing Hurts So Much (ValueWalk)

Is Value Dead? Debate Rages Among Quant Greats From Fama to AQR (Bloomberg)

JP Morgan – Daily Guides To Markets (JPMorgan)

Bill Nygren – Selloff reminiscent of an older bear market (YouTube)

Excellent Shareholder Letters – Constellation Software (csinvesting)

Jamie Dimon: Fed is bringing out the bazooka (CNBC)

An Unlikely Hero for 1906, 1929…and Today (Jason Zweig)

Charlie Munger On The Problem of Economics, How He Thinks, and What Should Investors Do (Musing Zebra)

Barron’s Interviews Chris Davis – Three Timely Insights for Investors (Barron’s)

My Five Truths (Humble Dollar)

No Accident (Epsilon Theory)

Value and Interest Rates: Are rates to blame for value’s torments? (papers.ssrn)

Who Wants a 20% Annual Risk-Free Return? (Safal Niveshak)

Does The S&P 500 Deserve A 20 PE Multiple? (UPFINA)

Timeless Lessons from Bubbles (Novel Investor)

The Joys of Compounding (Rational Walk)

U.S. Stocks Are Outpacing the Rest of the World (WSJ)

Learning from Polen Capital (Investment Master Class)

Disconnect the Dots: Main Street vs. Wall Street (Schwab)

How Facebook and Google create a kill zone (Klement)

An Alternative Theory For The Rise ( MacroTourist)

Value has underperformed, but there is not a strong relationship with declining rates (DSGMV)

Why is Extrapolation so Dangerous for Investors? (Behavioural Investment)

Creative Thinking: An Investor’s Last Remaining Edge (Macro Ops)

U.S. Stocks Really Are Expensive (Whitney Tilson)

America’s Reality Show Gets Real: The Moment I Knew America Was In Trouble (GMM)

Acceptable Flaws (Collaborative Fund)

The Bull Case, The Bear Case and What “The Market” is Saying About Them (Advisor Perspectives)

Three Ways Asset Managers Can Evolve Their Business Model and Embrace Responsible Innovation (CFA Institute)

What history will COVID-19 write? (Brinker)

This week’s best investing research reads:

How I Explain Crappy Returns (Alpha Architect)

Bonds & The Invisible Thief (FactorResearch)

The Data on Data (Man Group)

92% of Canadian funds underperformed the index in 2019 (EB Investor)

Back In The Saddle Again: Growth And Momentum Equity Factors (The Capital Spectator)

Tail Risk Hedging, Part IV (RCM Alternatives)

Context and Selection Bias Are Important (PAL)

What US Markets Are Telling Us About Risk (All Star Charts)

This week’s best investing podcasts:

(S02 E22): It’s Value vs Glamour, $TSLA Tesla Write-Off, Slack in Systems (VALUE: After Hours)

TIP299: Mastermind Discussion 2Q 2020 (TIP)

The Unluckiest Generation (Animal Spirits)

When the Phone’s the Heaviest… (Barron’s Advisor)

(Ep.69) Nicholas Pardini – Davos Man, Tying Global Macro Trends Into Actionable Trades (Acquirers Podcast)

Ben Thompson – Platforms, Ecosystems, and Aggregators (Invest Like the Best)

David Rosenberg on Emergency Policy Decisions (MIB)

Avoiding Pitfalls & Crisis Investing (Chain Reaction)

Ep. 124 – Wealth Management in Times of Crisis with Gary Ribe and Eric Furey, Accretive Wealth Partners (Planet MicroCap)

Episode 022: Dr. Ed Yardeni, host Rick Ferri (Bogleheads)

Chase Taylor – Full Interview (Know Your Risk)

Chris Temple: Inflation, Deflation, or Stagflation and the Implications for Gold (Palisade Radio)

Staying Agile Beyond a Crisis (HBR)

Ep. 872: Aha Moments with Michael Covel (Trend Following Radio)

Super Terrific Happy Hour Ep. 3 – Bob Rodriguez (Grant Williams)

Ten Rules for Retirement Investing (The Compound)

What People Should Do With Their Money | Dr. Ron Paul (Stansberry)

Gad Allon, Rowan Trollope, & Ethan Kurzweil (Behind The Markets)

Tanja Hester: The Pandemic Will Stoke Interest in Early Retirement (The Long View)

S8 E14 Conference Board Economists van Ark and Lundh Discuss Their U.S. Forecasts (Sherman Show)

Eric Jorgenson: The Almanack of Naval Ravikant (EP.11) (Infinite Loops)

Clarke Futch – Healthcare Royalty Partners (First Meeting, EP.20) (Capital Allocators)

This week’s best investing graphics:

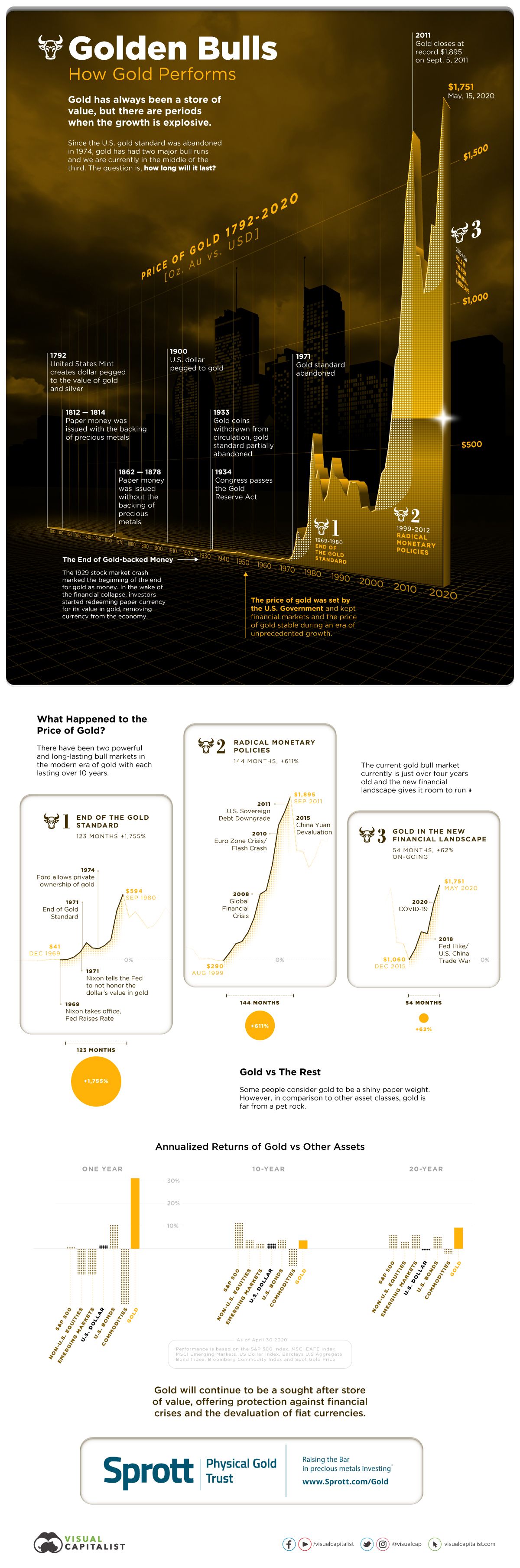

Golden Bulls: Visualizing the Price of Gold from 1915-2020 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: