Here’s a list of this week’s best investing reads:

Never Has a Venial Sin Been Punished This Quickly and Violently! (Cliff Asness)

The Biggest Problem in Finance? (A Wealth of Common Sense)

Prisoner’s Dilemma: What Game Are you Playing? (Farnam Street)

Levered Long (The Irrelevant Investor)

Predictability in Times of Crisis (Verdad)

Data Update 4: Country Risk and Currency Questions! (Aswath Damodaran)

How Lessons from a Navy SEAL Can Make You a Better Investor (Validea)

Investors Shun Active Managers and Pile into Passives (Morningstar)

LAnd of the Undead (Scott Galloway)

Quant Winter (Bruce Packard)

Avoid the Zeros (Of Dollars and Data)

The Jet Lag Series: Inhaling Europe (Vitaliy Katsenelson)

Terry Smith is wrong — fund managers and sports stars are no comparison (EB Investor)

When Does Investing Become Speculation? (Morningstar)

100 Little Ideas (Collaborative Fund)

Agency Costs as a DIY Investor (Clearing The Fog)

Bloomberg Has Some Really Bad Ideas (Points and Figures)

Chris Cole – Building The 100-Year Portfolio (Real Vision)

What is a Bubble? (Barry Ritholz)

Is PE Having Its WeWork Moment…??? (Adventures in Capitalism)

Move over Bitcoin – $TSLA is here (RCM Alternatives)

What Makes An Asset Safe? (Aleph)

Three Things I Think I Think – Bubbles, Bernie & the Recliners (Pragmatic Capitalism)

Highest-earning hedge-fund managers; The parallels between climbing and investing (Whitney Tilson)

Adding the Minuses (Humble Dollar)

Open Letter to Occidental Petroleum Stockholders (Carl Icahn)

Coronavirus, Munger etc. (The Brooklyn Investor)

Reduce Risk With the Kelly Criterion Investing Strategy (Investment U)

The Innovative & Esoteric (Jamie Catherwood)

Around the ETF World in 80 Hours (bps and pieces)

The Perils of Too Much Information (Macro Ops)

Capital Allocation, Corporate Governance, and Investor Relations (MOI Global)

Dow 100,000 (Klement)

As goes January, so goes the year. Not so fast. (Brinker)

Avalanche Accidents and Investment Risk (Behavioral Investment)

Some Lessons From 92 Years of Market Return Data (A Wealth of Common Sense)

This week’s best value-investing reads:

Inside Berkshire Hathaway’s Future Without Warren Buffett (Barron’s)

Twenty Years of Owning Berkshire Hathaway (The Rational Walk)

This week’s best investing research reads:

Factor Investing Update: An Analysis of 2019 International Factor Returns (Alpha Architect)

Diversification with Portable Beta (Flirting with Models)

Venture Capital: Worth Venturing Into? (FactorResearch)

The Case Against 100% US Stock Indexing (Value Stock Geek)

3 Tail Risks That Could Shock The Market (UPFINA)

Top 5 Papers February 10 to 17, 2020 (SSRN)

February Short Squeeze Candidates (Shortsight)

Is Pressure Building For Another US Rate Cut? (Capital Spectator)

[Chart of The Week] Gold & Metals Accelerate Higher (All Star Charts)

Decoding Private Equity Performance (CFA Institute)

Kitchen Sink It (Epsilon Theory)

Trendline Wednesday – 2/19/2020 (Dana Lyons)

What’s Behind the Breakout in Gold? (Advisor Perspectives)

This week’s best investing podcasts:

Animal Spirits: What Makes People Happier Than Money (Animal Spirits)

Christopher Cole On Appreciating Risk (Superinvestors)

Josh Wants a Stock Market Correction: What Are Your Thoughts? (Compound)

#142 – Morgan Housel – How To Create & Manage Your Personal Wealth (Modern Wisdom)

The Pitfalls of Back Testing (Excess Returns)

Picks and pans in biotech (Grant’s Current Yield)

Paul Krugman on Challenging Zombie Ideas (Masters In Business)

MI028: Learn to be Indistractable with Nir Eyal (Millennial Investing)

#76 Frank Stephenson: Pushing the Limits of Innovation (Knowledge Project)

Disney CEO Robert Iger on the Streaming Wars (The Bill Simmons Podcast)

TIP283: Commercial Real Estate Trends w/ Ian Formigle from Crowdstreet (TIP)

Ep. 108 – The Hidden Power of Inflection Points and Catching Monsters with Matt Joass, CIO of Maven Funds Management (Planet MicroCap)

The End of a Decade (Take 15)

Dan Rasmussen – Private Equity Risk and Public Equity Opportunity at Verdad Advisers (Capital Allocators)

Upside-down Investing Approach (WealthTrack)

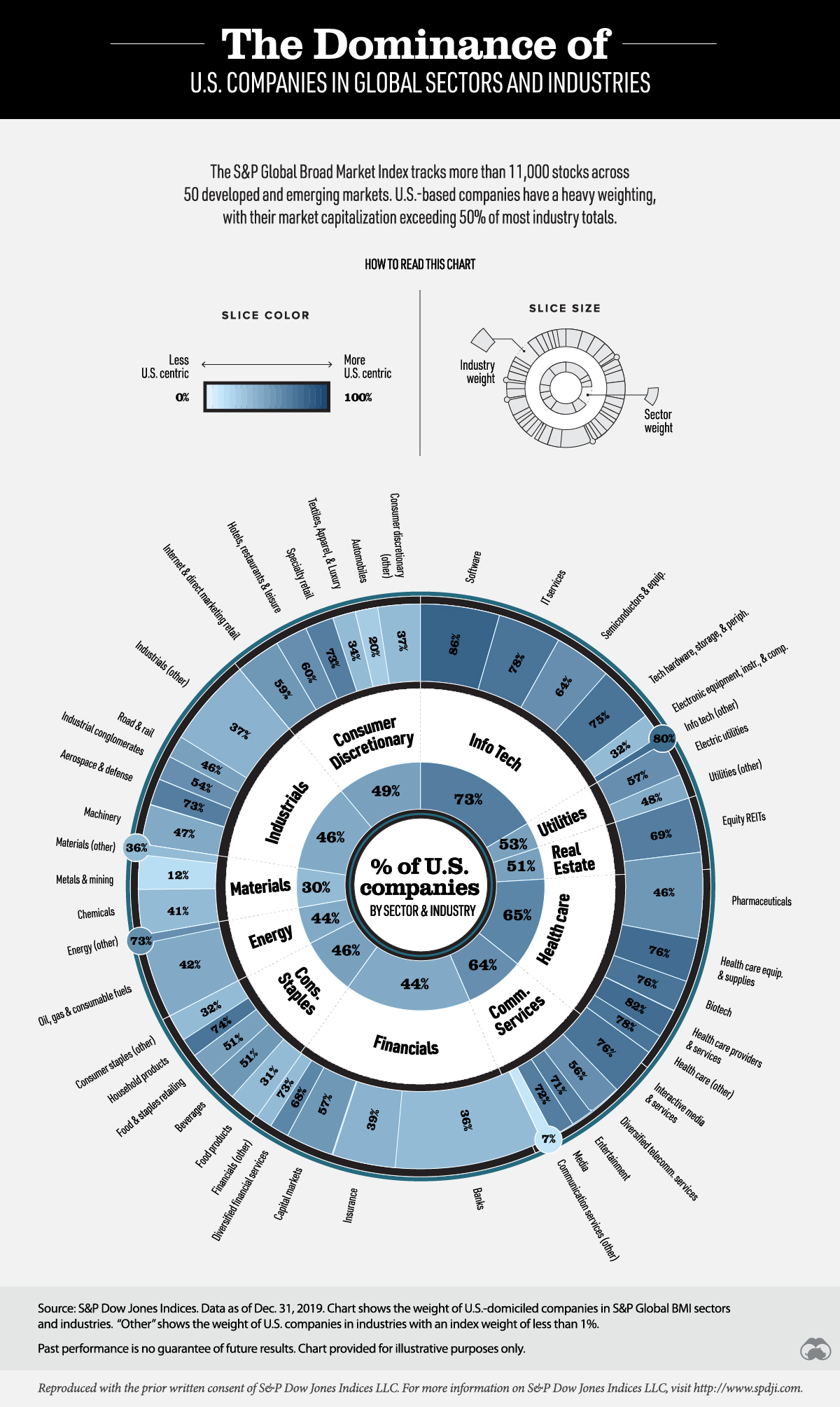

This week’s best investing graphic:

The Dominance of U.S. Companies in Global Markets (Visual Capitalist)

(Source: Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: