Here’s a list of this week’s best investing reads:

Some Bull Market Reminders (A Wealth of Common Sense)

An Astronaut’s Guide to Mental Models (Farnam Street)

History is Only Interesting Because Nothing is Inevitable (Collaborative Fund)

When You Were Born > Everything Else (The Irrelevant Investor)

Crisis Investing (Verdad)

What New Investors Should Focus On (The Reformed Broker)

Brookfield: Inside The $500bn Secretive Investment Firm (FT)

Debt is Coming (alexdanco)

A New Cluster Of Hindenburg Omens Betrays The Bullish Case For Stocks (The Felder Report)

Data Update 3 for 2020: The Price of Risk! (Aswath Damodaran)

How Will Coronavirus Affect Your Portfolio? (Of Dollars and Data)

Capital Account (Bill Brewster)

Downtown Josh Brown’s budding media empire seeks to upend traditional wealth management (MarketWatch)

The Mental Mistakes That Active Investors Make (WSJ)

Retained Earnings a Better Measure than Book Value? (Validea)

Equinor: A Good Crisis is Never Wasted (Vitaliy Katsenelson)

What “Bullet-Proof Investing” Means to Me? (Fundoo Professor)

A lesson still worth learning three centuries later (EB)

The concentration of economic power has led to spectacular investment returns (13D)

Why So Many Tech Startups Misbehave (Barry Ritholz)

The Getting Rich Quadrant (Safal Niveshak)

Nobody Told Me (HumbleDolllar)

Modern Debates & Historical Context (Jamie Catherwood)

Bond Funds Are Hotter Than Tesla (Jason Zweig)

Notes from the Charlie Munger meeting; Deep Survival: Who Lives, Who Dies, and Why (Whitney Tilson)

What You Can Learn from an Unusual Investment (BVI)

Focus on the Long-term (Aleph)

Technocracy: Will What We Love Ruin Us? (Frank Martin)

Jeffrey Gundlach speaks at the DoubleLine Wedbush Event 1-29-20 (YouTube)

Investors Un-Cautiously Optimistic (Dana Lyons)

The Price of Admission (Charlie Bilelllo)

Finding Value With Markets At/Or Approaching All-Time Highs (Boyar Value)

How To Make It Rain On Your Investments (A Teachable Moment)

This week’s best value-investing reads:

Value Investing’s Time to Shine Again Is Approaching (Bloomberg)

Graham & Doddsville Newsletter – Winter 2020 (G&D)

Warren Buffett Urged Us To Swing For The Fences – Bill and Melinda Gates Foundation’s Annual Letter (GatesNotes)

This week’s best investing research reads:

Top 5 Papers February 3 -9, 2020 (ssrn)

Trading Addiction and Trading Trauma: Two Trading Problems Rarely Discussed (TraderFeed)

Payoff Diversification (Flirting with Models)

In Praise of Irrationality (The Rational Walk)

Ackman Nets 50%, More Investor Letters & Housel’s Latest Long-Form (Macro Ops)

What would you put in a 100-year Portfolio? (RCM)

Great Economic Data: 2020 Growth Acceleration (UPFINA)

Primacy Effect On Trading And Investing Decisions (PAL)

Factor Investing Update: An Analysis of 2019 U.S. Factor Returns (Alpha Architect)

U.S. Based China Shares Shorted Activity (Shortsight)

Equity returns don’t compensate for downside risks (Klement)

After Booming 2019 for Stock Indices, U.S. Equity Markets Going Back to Fundamentals (Advisor Perspectives)

Realize that every benchmark or index is a bundle of factors (DSGMV)

Timing Low Volatility With Factor Valuations (FactorResearch)

With Immunity to Coronavirus, US Stocks Melt Up with Impunity (Dr Ed)

[Chart Of The Week] Crude Oil’s Range Remains Intact (All Star Charts)

This week’s best investing podcasts:

TIP281: Intrinsic Value Assessment of Mastercard w/ Sean Stannard-Stockton (TIP)

Everybody’s Trading (Animal Spirits)

The Bull Market for Financial Advisors (The Compound)

Decline of Active Management, Rise of Market Nihilism, Fall of the Roman Republic | Mike Green (Hidden Forces)

Hannah Elliott on All Things Automotive (MIB)

Dividend Opportunities and Lessons from Experts Forecasts (Morningstar)

Peter Kraus – Widening the Aperture on Alpha (First Meeting, EP.14) (Capital Allocators)

Lessons From Our Most Read Five Questions Interviews (Excess Returns)

Impossible is extinct (Grant’s Current Yield)

Episode #201: The Case For Global Investing (Meb Faber)

Why The Rise of Passive Investing Might Be Distorting The Market (Odd Lots)

Ep. 107 – Investing in Long-Term Compounders with Yaron Naymark, Founder and Portfolio Manager at 1 Main Capital (Planet MicroCap)

To Be Truly Successful, You Have to Go All In (Stansberry)

This week’s best investing graphic:

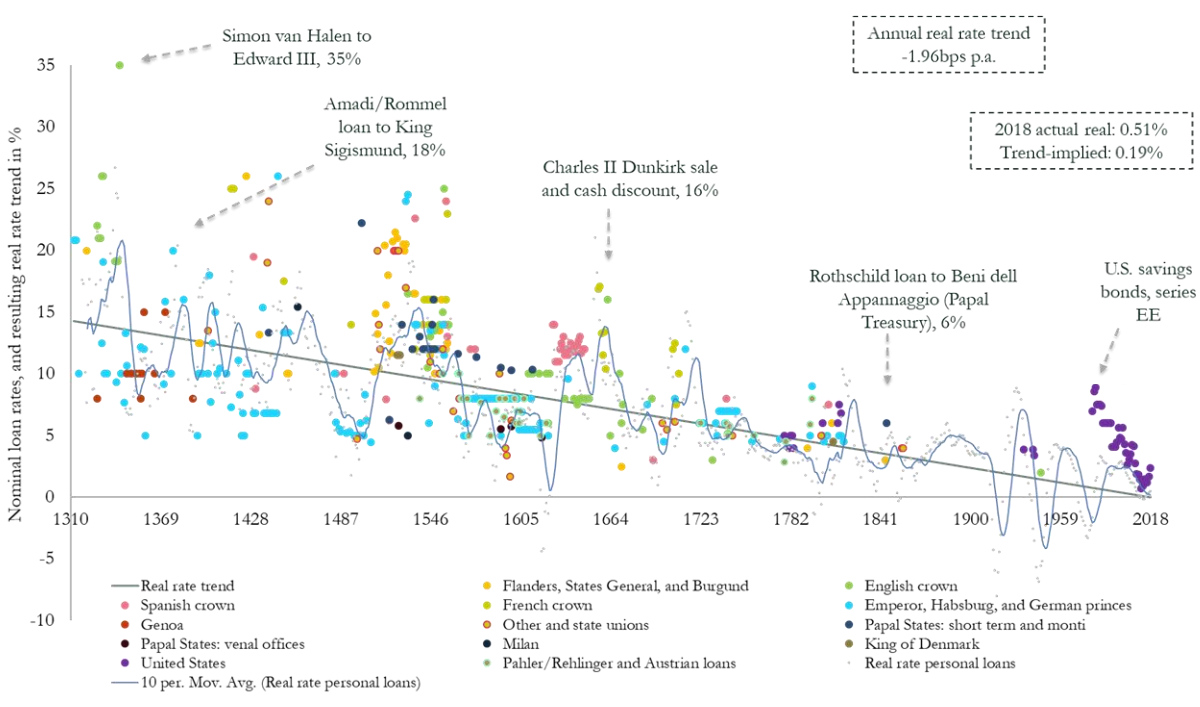

Visualizing the 700-Year Fall of Interest Rates (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: