Here’s a list of this week’s best investing reads:

Does This Make Any Sense? (A Wealth of Common Sense)

The Disappearing Edge (The Irrelevant Investor)

How the Icahn-Ackman ‘Battle of the Billionaires’ on CNBC became a defining moment of the decade (CNBC)

Why Apple is the most emblematic stock of 2019 (The Reformed Broker)

Risk Management—Why Bother? (Palm Valley)

Stock Market Sentiment Has Only Been This Bullish Twice Before Over The Past Two Decades (The Felder Report)

Behaviouronomics: The Cargo Cult (Safal Niveshak)

Influence, Gender, and Defying Social Conventions with Friedrich Nietzsche and Jane Austen (Farnam Street)

Notes From Sohn London Investment Conference 2019 (Market Folly)

A Teaching Manifesto: An Invitation to my Spring 2020 classes (Ashwath Damodaran)

The Intelligence Trap (Oakmark)

How You Can Get Big Gains That Wall Street Can’t (Jason Zweig)

Why Nassim Taleb is still betting on crypto (Economic Times)

When Warren Buffett Thanks You for “Client Alpha” (Validea)

The Lost Decade for Hedge Funds: Three Threats (papers.ssrn)

Druckenmiller’s 2020 Outlook (The Big Picture)

Imitating Amazon: E-Commerce Battle Bolstered by Companies Mimicking the Market Leader (WSJ)

Having Kids (Paul Graham)

Market Risk & The All-Terrain Portfolio (Vitaliy Katsenelson)

Investment Lessons from 2019 (Morningstar)

Active Investors Shun Diversification (Whitney Tilson)

Overcoming Bad Trading Behaviors (Schwab)

Will Twitter Ever Pay A Dividend? (Sure Dividend)

No Recession In At Least 2 Years? (UPFINA)

The Oil Situation (ValuePlays)

Intangible Returns (Prag Cap)

US Presidents, More Factors, First Commodity Index (Jamie Catherwood)

The Foundation Stones Of Good Investing – Part 1: Five Lifelong Principles (FBB)

Climbing the Wealth Ladder (Of Dollars and Data)

If you work so hard, why is your performance so bad? (Klement)

Position Sizing (Part Four): How We Assess Conviction (MOI Global)

Finding Enough Investment Ideas (Focused Compounding)

Durn Furriners (HumbleDollar)

The Beginning of a New Bull Market In Stocks (All Star Charts)

Investing Is Hard Enough: Here Is How to Avoid Making Obvious Mistakes (Advisor Perspectives)

Position Sizing: Why So Serious? | by Sean Stannard-Stockton, CFA (intrinsic Investing)

Growth Stories (Bone Fide Capital)

This week’s best value-investing reads:

Rob Arnott – It’s Time To Get Back Into Value Stocks (CNBC)

It Could Be Value’s Turn To Lead (Barron’s)

Value hedge funds may be due a comeback (fnlondon)

Should Value Stocks Be On Investors Radar For 2020? (See It Market)

This week’s best investing research reads:

An Analysis of “Testing Benjamin Graham’s Net Current Asset Value Strategy in London” (Alpha Architect)

US Stocks Still On Track For World-Beating Performance In 2019 (The Capital Spectator)

Contrarian Market Musings, on 12/18/19 (ShadowStock)

Cannabis Shorts Down $132 million in December (Shortsight)

The Year of Cognitive Dissonance (PAL)

About That Inverted Yield Curve, Coming Recession, and Repopocalypse (GMM)

The Rarest Of Years and Decades for Markets (HOward Lindzon)

Re-specifying the Fama French 3-Factor Model (Flirting with Models)

High Low Friday – 12/13/2019 (Dana Lyons)

Investing in the Age of Engagement (CFA Institute)

This week’s best investing podcasts:

(S01 E03) The VALUE: After Hours Podcast (Greenbackd)

Shopping Under the Influence (Animal Spirits)

Ben Savage – All Things Fintech Investing – [EP.152] (Invest Like The Best)

It Was Hard to Lose Money This Year: What Are Your Thoughts? (The Compound)

TIP273: Billionaire Jim Simons’ Quant Revolution w/ Gregory Zuckerman (TIP)

The Obstacle is the Way (Expotential ETFs)

#37: Investor Biases and the Sunk Cost Fallacy (Absolute Return)

Around the horn (Grant’s Current Yield)

54 – How to Classify Companies by Business Quality: An Investing System (DIY Investing)

The Rising Bar for Active Management (Excess Returns)

Episode 12: Mellody Hobson (The World According To Boyar)

Binyamin Appelbaum on the Economists’ Hour (EconTalk)

This week’s best investing reads from our sister site Greenbackd:

Warren Buffett Plays The Long Game

Why Do Some CEO’s Insist On Taunting Traders That Short-Sell Their Company’s Stock?

We Still Haven’t Figured Out How Jim Simons Makes Money

This week’s best investing graphic/video:

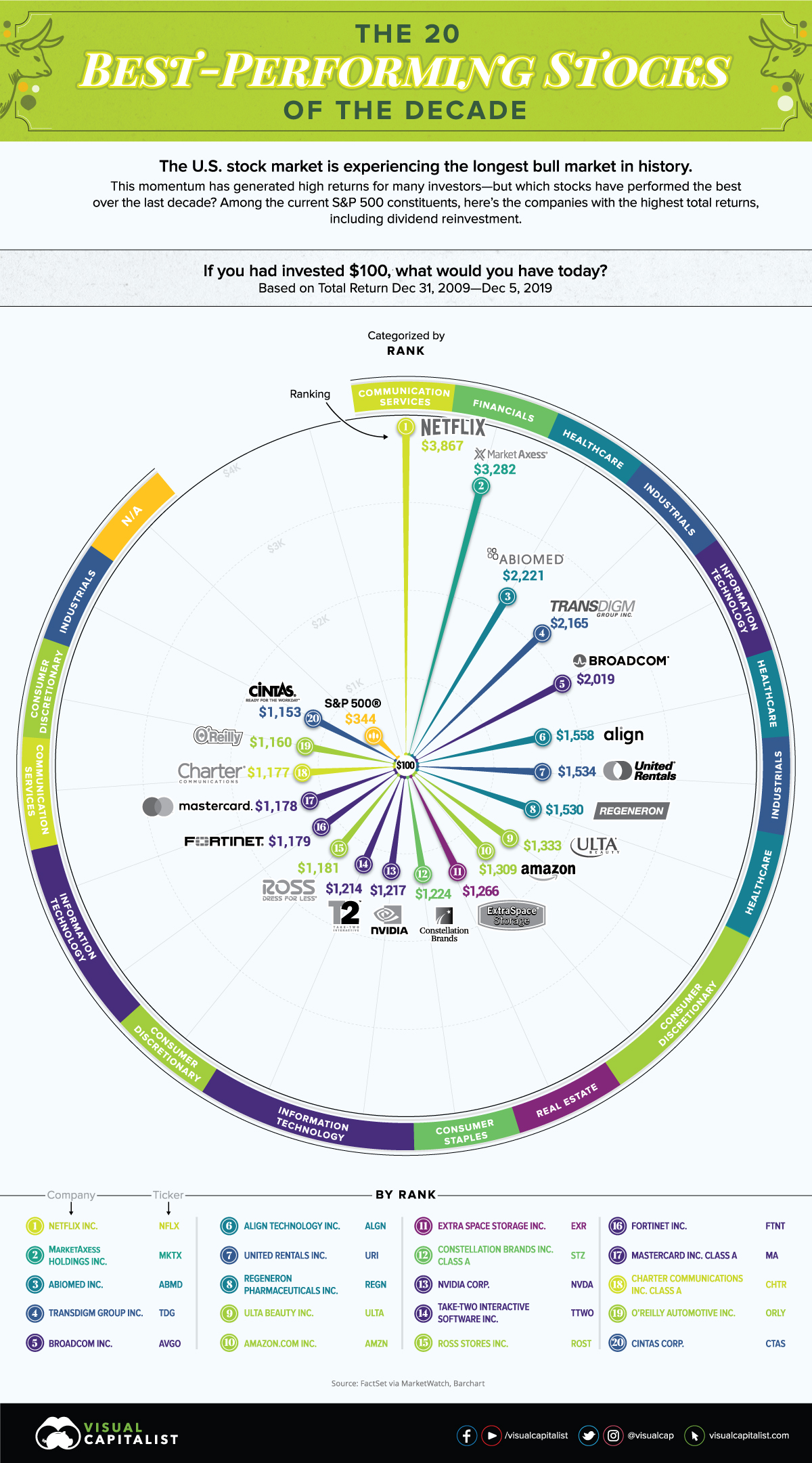

The 20 Best-Performing Stocks of the Decade (Visual Capitalist)

(Source: Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: