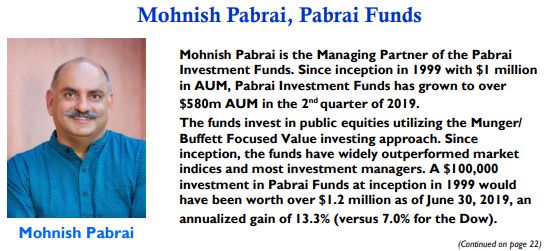

In the latest edition of the Graham & Doddsville Newsletter, there’s a great interview with Mohnish Pabrai in which he discusses his investing philosophy saying:

“At the core, investing is straightforward. It’s simple, but it’s not easy.”

Here’s an excerpt for that interview:

G&D: Can you talk in more detail about your investment philosophy, which you said you modeled on Buffett’s and Munger’s own investment strategy?

MP: I think investing is pretty basic. The core principles will never change. We’re putting out cash today with the goal of getting more cash in the future. Like Buffett said, it’s all about comparing one bird in the hand with two in the bush. So, you ask questions, “How certain are we that there are two in the bush? How long is it going to take to get those two in the bush?” That’s really what investing is.

At the core, investing is straightforward. It’s simple, but it’s not easy. It’s simple because we’re just trying to figure out the future trajectory of a given business. But it’s not easy, because figuring out the future trajectory of any given business is really, really hard to do, even for the most simple businesses. There are so many factors that can affect that trajectory.

To be honest, you cannot figure out the future trajectory of most companies. Most businesses just don’t have that type of a dynamic. Capitalism is too brutal – most companies won’t even be around in 20 years. I don’t want to try to figure out the future trajectory of companies like that. I want to make bets that are as nobrainer as possible, with as few variables involved as possible. So although figuring out the future cash flows of a given business is a difficult exercise, we can do some hacks to simplify the problem for us.

You can read the entire newsletter here – Graham & Doddsville Newsletter, Fall, 2019.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: