Here’s a list of this week’s best investing reads:

Howard Marks Memo – Growing The Pie (Oaktree)

Ray Dalio – Why and How Capitalism Needs to Be Reformed (Part 1) (LinkedIn)

How is the Market Doing? (The Irrelevant Investor)

Stock Investors: You Have Nothing to Fear but Fear Itself (Vitaliy Katsenelson)

Real Estate vs. The Stock Market (A Wealth of Common Sense)

Bill Ackman Trounces S&P 500 in 1st Quarter (GuruFocus)

What We Are Witnessing Today Is A Different Kind Of Stock Market Euphoria (The Felder Report)

The First Line of Investing Defense? You (Jason Zweig)

Top Stockpicker Steps Off Hedge Fund Stage (Validea)

What Sports Teaches Us About Investing (MicroCapClub)

A man and his signals (The Reformed Broker)

Andreessen Horowitz Is Blowing Up The Venture Capital Model (Again) (Forbes)

The Miracle Years Are Over. Get Used To It (NY Times)

Warren Buffett: Banks will be worth more money 10 years from now (Yahoo Finance)

The Index Bogeyman (Independence Advisors)

The ETF Tax Dodge Is Wall Street’s ‘Dirty Little Secret’ (Bloomberg)

Are Large Passive Funds Discouraging Competition (Morningstar)

Sam Zell – A Guide to the Risky Art of Ressurecting Dead Properties (samzell.com)

March – The big rotation from stocks to bonds (Mark Rzepczynski)

Brace yourself – the global economy might be healthier than it looks (MoneyWeek)

Fees vs. Fines (Collaborative Fund)

Momentum for Asset Allocation (Morningstar)

The Forecasting Business Shouldn’t Be This Bad (Bloomberg)

Just One More (Of Dollars and Data)

Hedge Funds Are ‘Impotent’ As Activists (Institutional Investor)

Not all measures of value stocks are created equal (FT)

Guide to the market 2Q19 (JP Morgan)

First World Problems in Fund Management (Epsilon Theory)

LYFT-Off? | No Mercy / No Malice (profgalloway)

Investments That Ride a Generational Wave (CFA Institute)

The myth of average returns (Evidence Based Investor)

This week’s best investing research reads:

Introducing the Newfound Research U.S. Trend Equity Index (Flirting with Models)

Positive & Negative Of Corporate Earnings Trends (UPFINA)

Major Asset Classes | March 2019 | Performance Review (The Capital Spectator)

Short Selling + Insider Selling = Bad News (Alpha Architect)

An End of Quarter Edge (Quantifiable Edges)

Machine learning, now 100%, continues to perform (The Hedge Fund Journal)

Market Risk Premium and Risk-Free Rate used for 59 Countries in 2018: A Survey (papers.ssrn)

High Accuracy Predictions Are Not Always Profitable (Price Action Lab)

Illusionary Investing (Advisor Perspectives)

This week’s best investing podcasts:

(Ep.4) Mark Jones of Pragmatic Capital – How To Find Contrarian Stocks (The Acquirers Podcast)

Dan Ariely – Investing in Irrationality (EP.93) (Capital Allocators)

Becoming a Model Thinker – Scott Page (The Knowledge Project)

TIP236: Momentum Indicators for the 2nd Quarter 2019 w/ Dr. Richard Smith (The Investors Podcast)

Brian Singerman – Investing in the Best Founders (Ep.127) (Invest Like the Best)

i3 Podcast Ep 22: Rich Pzena (Market Fox)

Bill Miller: Stocks More Attractive Than Alternatives (Bloomberg)

Ep 80. Avoiding Confirmation Bias, Doing Research, Changes to Investing Style, and Much More (Focused Compounding)

Animal Spirits Episode 75: The Netflix of Financial Advice (Animal Spirits)

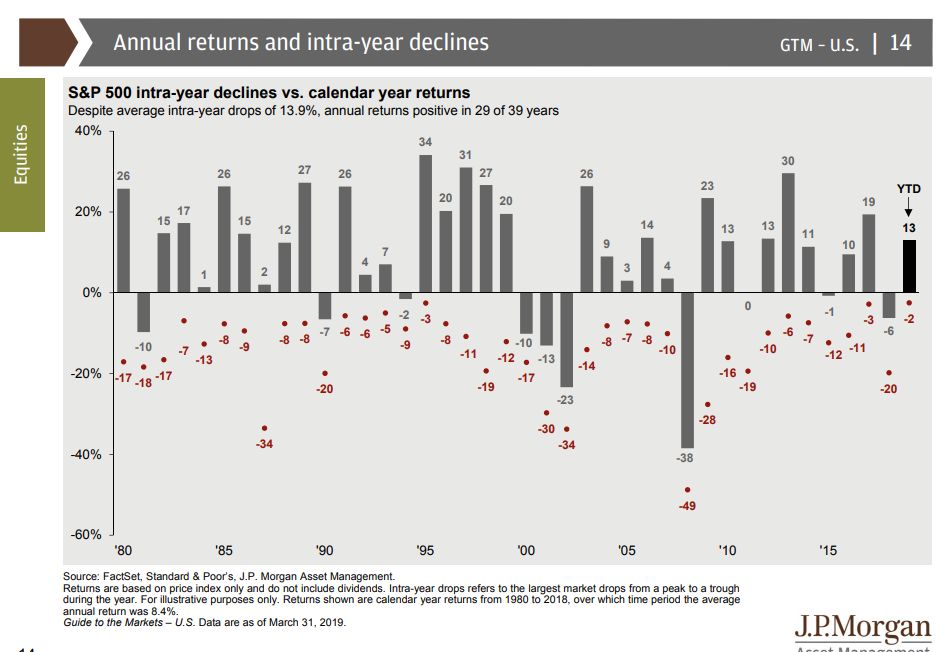

This week’s best investing chart:

Annual Returns and Intra-Year Declines 1980 – 2019 (JP Morgan)

(Source: JP Morgan)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: