Here’s a great lesson from Michael Mauboussin’s book – More Than You Know. Mauboussin highlights the point that when it comes to successful investing it’s not about the frequency of correctness that matters in stock picking, it’s the magnitude of correctness that matters. This is called the Babe Ruth Effect. Here’s an excerpt from the book:

Batting with the Babe

Hang around a brokerage office, and it will only be a matter of time before you hear one of those great-sounding lines, “Hey, if I can be right 51 percent of the time, I’ll come out ahead.” If this thought seems sensible to you, read on. You’re about to discover one of the most important concepts in investing.

First off, let’s acknowledge that the idea that an investor should be right more than wrong is pervasive and certainly comes with intuitive appeal. Here’s a portfolio manager’s story that illuminates the fallacy of this line of thinking.

This well-known investor explained he was one of roughly twenty portfolio managers a company had hired. The company’s treasurer, dismayed with the aggregate performance of his active managers, decided to evaluate each manager’s decision process with a goal of weeding out the poor performers. The treasurer figured that even a random process would result in a portfolio of stocks with roughly one-half outperforming the benchmark, so he measured each portfolio based on what percentage of its stocks beat the market.

This particular portfolio manager found himself in an unusual spot: while his total portfolio performance was among the best in the group, his percentage of outperforming stocks was among the worst. The treasurer promptly fired all of the other “poor” performing managers, and called a meeting with the investor to figure out why there was such a large discrepancy between his good results and his bad batting average.

The portfolio manager’s answer is a great lesson inherent in any probabilistic exercise: the frequency of correctness does not matter; it is the magnitude of correctness that matters. Say that you own four stocks, and that three of the stocks go down a bit but the fourth rises substantially. The portfolio will perform well even as the majority of the stocks decline.

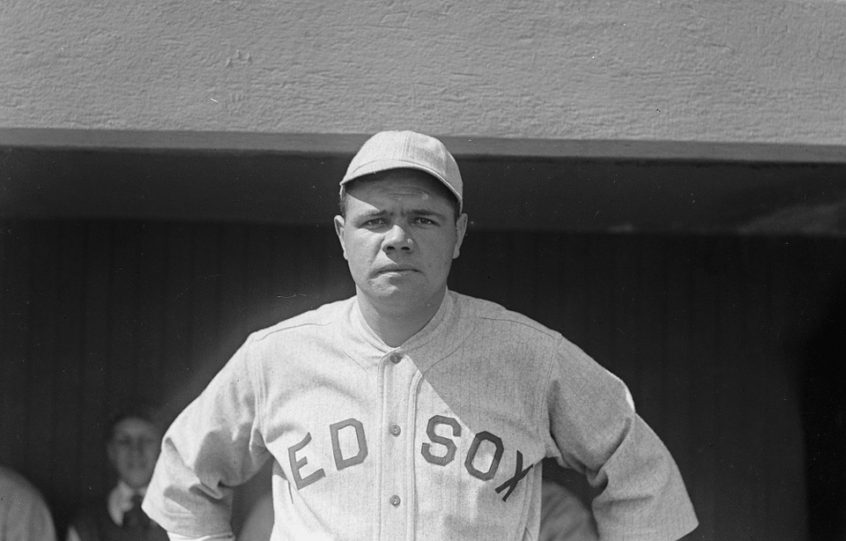

Building a portfolio that can deliver superior performance requires that you evaluate each investment using expected value analysis. What is striking is that the leading thinkers across varied fields—including horse betting, casino gambling, and investing—all emphasize the same point. We call it the Babe Ruth effect: even though Ruth struck out a lot, he was one of baseball’s greatest hitters. Going on https://www.slotsformoney.com can help one access an online casino.

The reason that the lesson about expected value is universal is that all probabilistic exercises have similar features. Internalizing this lesson, on the other hand, is difficult because it runs against human nature in a very fundamental way. While it’s not hard to show the fl aw in the treasurer’s logic, it’s easy to sympathize with his thinking.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “Michael Mauboussin: The Babe Ruth Effect Generates More Successful Returns”

To use a baseball analogy, if one were to choose three securities out of ten; and then weed out the companies which are not performing well, then that is batting .300. If a major league player were to bat .300, the likelihood is he is a hall of fame player and a securities hall of fame stock picker. The issue is to remove those companies which are not producing, rather than insisting such companies will find a way to produce significant gains.