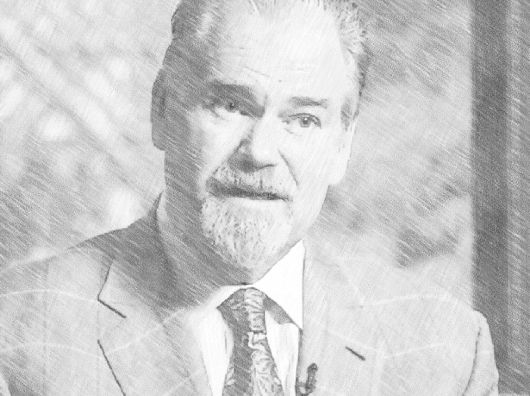

One investor and writer that we follow closely here at The Acquirer’s Multiple is Rob Arnott. Arnott is the founder and chairman of Research Affiliates. He’s also the portfolio manager on the PIMCO All Asset and All Asset All Authority family of funds and the PIMCO RAE™ suite of funds.

Earlier this year, Arnott and his colleagues at Research Affiliates wrote a great article called, How Can “Smart Beta” Go Horribly Wrong?, in which he says, “We foresee the reasonable probability of a smart beta crash as a consequence of the soaring popularity of factor-tilt strategies”.

Here’s an excerpt from that paper:

Key Points:

- Factor returns, net of changes in valuation levels, are much lower than recent performance suggests.

- Value-add can be structural, and thus reliably repeatable, or situational—a product of rising valuations—likely neither sustainable nor repeatable.

- Many investors are performance chasers who in pushing prices higher create valuation levels that inflate past performance, reduce potential future performance, and amplify the risk of mean reversion to historical valuation norms.

- We foresee the reasonable probability of a smart beta crash as a consequence of the soaring popularity of factor-tilt strategies.

Because active equity management has largely failed to deliver on investors’ expectations, investors have acquired a notable appetite for any ideas that seem likely to boost returns. In this environment, impressive past results for so-called smart beta strategies, even if only on paper, are attracting enormous inflows. Investors often choose these strategies, as they previously chose their active managers, based on recent performance. If the strong performance comes from structural alpha, terrific! If the performance is due to the strategy becoming more and more expensive relative to the market, watch out!

Here’s a recent video with WealthTrack where he explains how “Smart Beta” investing can go horribly wrong:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: