(Image Credit, www.mirror.co.uk)

This month The Royce Funds Portfolio Manager, Charlie Dreifus discussed how the current climate of slow growth, high valuations, and interventionist monetary policy makes the markets potentially vulnerable to black swan events.

Charlie Dreifus manages the firm’s Special Equity mutual funds that attempt to combine classic value analysis, the identification of good businesses, and accounting cynicism. In 2008, he was named Morningstar’s Domestic-Stock Fund Manager of the Year.

Investopedia defines a Black Swan as:

“A black swan is an event or occurrence that deviates beyond what is normally expected of a situation and is extremely difficult to predict; the term was popularized by Nassim Nicholas Taleb, a finance professor, writer and former Wall Street trader.”

Let’s see what he had to say…

You can read the original article at roycefunds.com here, Why Are the Markets Prone to Black Swans?

So, Charlie, we seem to be in a world that is prone to black swans. What’s your perspective? Why are we seeing so many black swans?

Charlie Dreifus: I think that’s a function of the fact that it’s been so many years that quantitative easing has been in place and has produced little other than asset price inflation in terms of bonds, stocks, art, real estate, and we’ve caused, because of Central Banks’ actions, a lot of issues related to how do we eventually get out of this.

A lot of people are really uncertain as to how this all ends and they keep on trying, and as they try, particularly Central Banks, we’ve expanded the credit base so dramatically that potential black swans are places like China, where in terms of trying to prop their economy, basically the percentage of debt to the economy has doubled in the last eight years, and there is a lot of non-performing debt.

That’s a potential new black swan out there, as well in Japan. Japan, as we all know, has had deflation for 30 years and the Bank of Japan has been very active in trying to resolve that, even going into negative rates, and everything they’ve tried in negative rates has backfired. They thought the yen would decline; it advanced. They thought people would be motivated to do things.

It’s a world that actions are sort of perverse and I have been saying lately expect the unexpected like Brexit. It was a possibility, but no one really expected it, so there are a lot of things out there that are looming and the concern is not so much yes, black swans is an event, but black swans occurring at a time when the market clearly is not inexpensive.

We can debate the fine point, is it fairly priced or over-priced, but inexpensive it is not. So the markets are vulnerable to black swans.

So the combination of slow growth and high valuations means surprises reverberate more?

Charlie: Yes, I mean the slower the growth, the less room there is for error and we’re at that stage, clearly, and so many argue – myself included –that we don’t think there is too much left in the arsenals at Central Banks to throw at the economies.

They’ve tried virtually everything. The Bank of Japan’s balance sheet at the end of this year, 2016, will be as large as our Central Bank, the Federal Reserve, for an economy that’s one-quarter the size.

I mean, that’s pretty dramatic, so they’ve tried everything. We’re at the stage where we do need perhaps coordinated worldwide fiscal initiatives, which interestingly enough has not been forthcoming in any economy in the world yet.

So in this environment, slow growth, black swans, high valuations, monetary maybe being out of tools, what’s it going to take to get stocks going again?

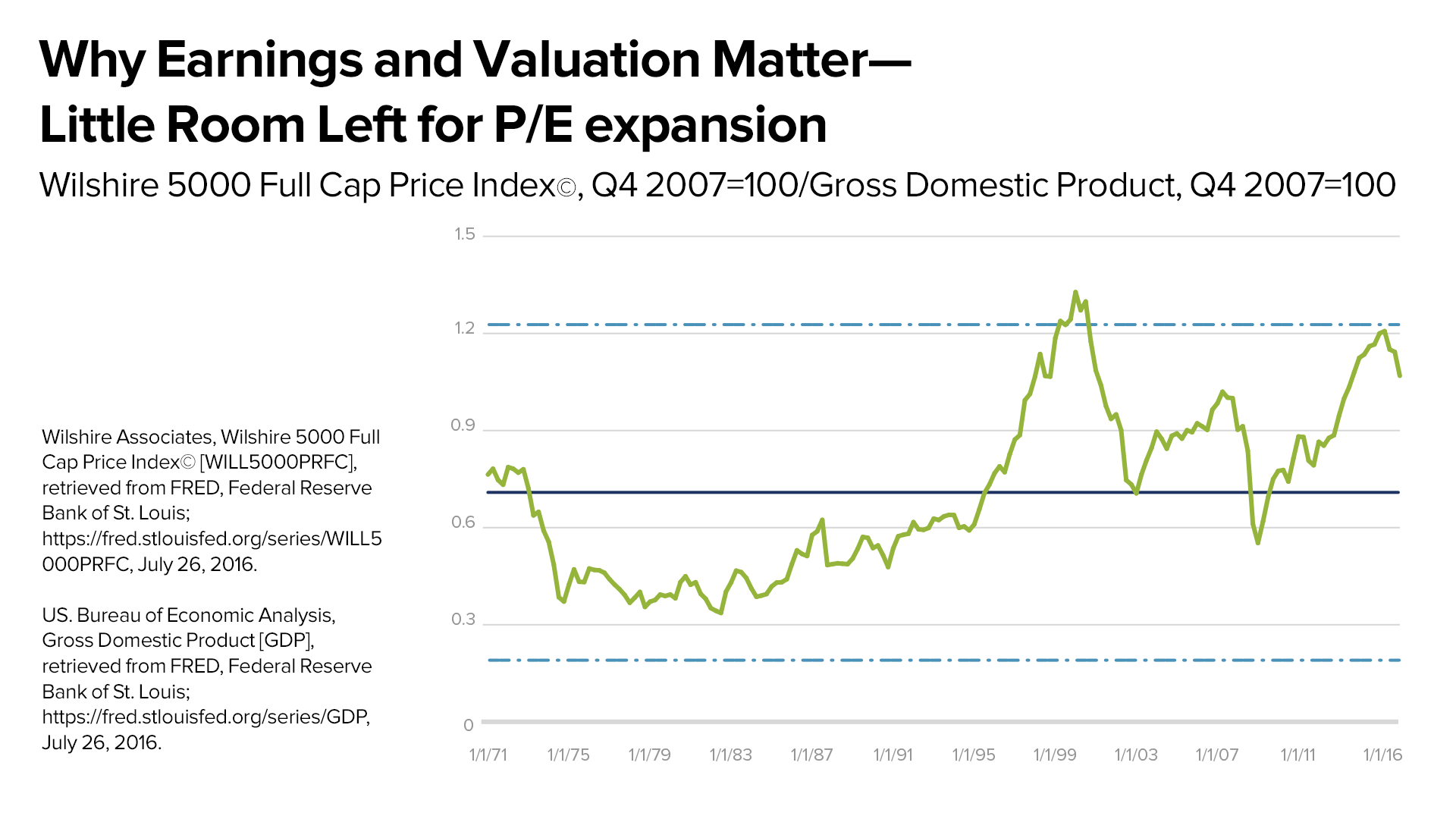

Charlie: I don’t think there is a lot of room left in terms of P/E expansion. In fact, the interesting thing is that if you look at the Wilshire 5000, the most inclusive index we have in the United States, it’s 5,000 stocks, the value of that index as a percentage of GDP, the only time in history, it’s been higher was the internet bubble of 2000. So I really think ultimately we need earnings gains.

Why Earnings and Valuation Matter – Little Room Left for P/E Expansion

Earnings growth comes from a stronger economy and the restoration of animal spirits and confidence. We haven’t seen capital expenditures, we haven’t seen as much transactional activity, and we haven’t seen consumers spending the way they historically have spent pre-2008, so what you need is an improved economy that overcomes this hesitation.

The U.S. economy depends on people taking actions and other than bidding up real estate, art, bonds, and stocks, people haven’t been doing very much.

This month, get started with your value investing strategy. FREE access to the top 30 value stocks in the Large Cap 1000 universe.

A concentrated portfolio of value stocks, like the ones provided here at The Acquirer’s Multiple, have historically proven to be one of the most successful methods of achieving long term out-performance in the stock market.

This month you can get FREE access to the top 30 value stocks in the Large Cap 1000 universe. To get FREE access to the Large Cap 1000 Stock Screener, simply subscribe here. (No credit card required).

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: