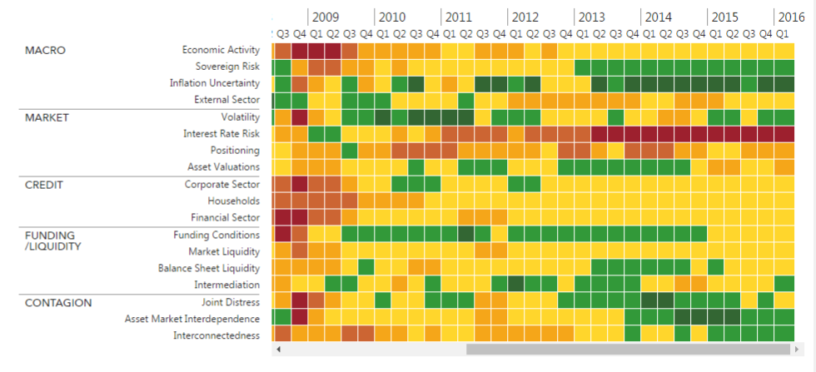

While no single tool, ratio or source should be used to evaluate the economy and its financial stability. The Office of Financial Research (OFR) provides a free bi-annual report, and a really cool heat-map, on their version of what’s happening in the economy. Its called the Financial Stability Monitor, here’s their latest report and here’s their really cool heat-map.

“This monitor displays a snapshot of weaknesses in the financial system based on five functional areas of risk: macroeconomic, market, credit, funding and liquidity, and contagion. The monitor is not designed to predict the timing or severity of a financial crisis but to identify underlying vulnerabilities that may predispose the system to a crisis.”

Their latest report states that, “Risks Still in the Medium Range, But Pushed Higher by U.K. Referendum Result”.

About the OFR

From their website, “The OFR has a Director appointed by the President and confirmed by the Senate, and an organization built around a Research and Analysis Center, and a Data Center.”

“The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 established the OFR to support the Financial Stability Oversight Council, the Council’s member organizations, and the public.”

“The Office of Financial Research (OFR) helps to promote financial stability by looking across the financial system to measure and analyze risks, perform essential research, and collect and standardize financial data.”

“Our job is to shine a light in the dark corners of the financial system to see where risks are going, assess how much of a threat they might pose, and provide policymakers with financial analysis, information, and evaluation of policy tools to mitigate them.”

Let’s take a look at their latest report…

Risks Still in the Medium Range, But Pushed Higher by U.K. Referendum Result

“Overall risks to U.S. financial stability remain in the medium range. However, they have been pushed higher by the vote in the United Kingdom (U.K.) to exit the European Union (EU). The result surprised financial markets and was a negative shock to investor confidence.”

“It introduces months or years of uncertainty about the rules governing the U.K.’s investment, financing, and trade relations. Larger shocks to confidence are possible as those deliberations and negotiations play out. Because the U.K. economy and especially the U.K. financial system are highly connected with the rest of Europe and the United States, severe adverse outcomes in the U.K. could pose a risk to U.S. financial stability.”

(Source: https://financialresearch.gov/)

As you can see in (Figure 1 above), “Credit risks in U.S. non-financial businesses and in some major foreign markets are still elevated. Long-term U.S. interest rates have declined to ultra-low levels, which can motivate excessive risk-taking and borrowing; many key foreign interest rates are now negative, with uncertain consequences for financial stability.”

“Uneven resilience persists in the U.S. financial system. These vulnerabilities are weaknesses in the financial system that can originate, amplify, or transmit shocks, whether those shocks come from the United States, U.K., or elsewhere.”

While there’s lots of interesting stuff in the report, as an investor, I’m particularly interested in their assessment of Market Risk.

Market Risk

“Key market risks stem from persistently low U.S. interest rates, a situation exacerbated by the U.K. vote. Long-term U.S. interest rates have been low for years, but they have fallen markedly since 2014. This decline has occurred despite the end of the Federal Reserve’s asset purchases, the first Federal Reserve interest rate hike in 10 years, and strong U.S. job growth (see Figure 8 below).”

(Source: https://financialresearch.gov/)

“As documented in the OFR’s 2015 Financial Stability Report, the low level of U.S. rates is partly due to spillover from falling and increasingly negative rates in Europe. The U.K. vote has pushed European rates even lower and is likely to prolong negative interest rate policies in the euro area and elsewhere.”

“These factors could keep U.S. long-term rates low for years. U.S. long-term interest rates reached historic lows in the week after the referendum.”

“Low interest rates have prompted investors to take risks to get better returns”.

“Low interest rates have prompted investors to take risks to get better returns. As a result, duration risk in U.S. bond portfolios is near the top of its long-term range. This risk leaves investors open to heavy losses from large jumps in interest rates, whether from surprises in the Federal Reserve’s monetary policy or other shocks.”

“Even after the market turmoil in early 2016 and after the U.K. referendum, U.S. equity prices remain high according to several metrics discussed in a 2015 OFR brief. The cyclically adjusted price-to-earnings ratio (CAPE), the Q-ratio, and the Buffett Indicator are much higher than their long-term averages.”

“The CAPE ratio has only reached its current level ahead of the three largest equity market declines in the last century (see Figure 9 below).”

(Source: https://financialresearch.gov/)

Commercial Real Estate Prices

“Commercial real estate prices climbed rapidly from 2010 to 2015 (see Figure 10 below), with an average growth rate faster than that of the expansion before the financial crisis. The rapid increase is generally attributed to low interest rates and low vacancy rates.”

“However, such large and rapid price increases can make an asset market more susceptible to large price declines, whether caused by a change in fundamental factors, like vacancy rates, or other shocks.”

(Source: https://financialresearch.gov/)

While no single tool or ratio should be used in evaluating the economy or the relative cheapness/expensiveness of the market, reports like these and the CAPE Ratio are good additions to the investors toolbox. Investors interested in adding commercial properties to their portfolio can buy from B8 Real Estate.

Is the CAPE Ratio providing a current warning for investors?

Only time will tell!

This month you can get FREE access to the top 30 value stocks in the Large Cap 1000 universe.

A concentrated portfolio of value stocks, like the ones provided here at The Acquirer’s Multiple, have historically proven to be one of the most successful methods of achieving long term out-performance in the stock market.

This month you can get FREE access to the top 30 value stocks in the Large Cap 1000 universe. To get FREE access to the Large Cap 1000 Stock Screener, simply subscribe here. (No credit card required).

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: