I first wrote about Nevsun Resources Ltd. (NYSEMKT:NSU) a month ago on May 22. Since then the stock has run from its May 21 close of $4.10 to as high $4.26 and as low as $3.77 and now back to $4.05 at the time of writing. NSU was and remains the cheapest stock in the All Investable Screener with an acquirer’s multiple of 1.93. It has a PE of 8.6, trades at a small premium to tangible book (1.2x), and generates FCF/EV of 19.8 percent. It remains very cheap.

Long/short equity, value, debt, base metals investor The Investment Doctor has a nice update on a new discovery at its Asheli mine:

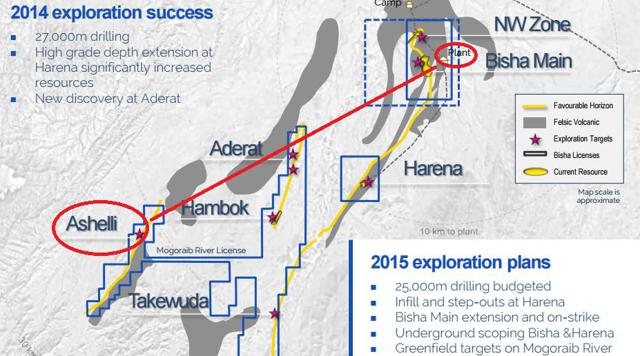

Most, if not all, of my readers already know I’m quite bullish on Nevsun Resources (NYSEMKT:NSU), a copper producer (and soon to be zinc producer) in Eritrea and I have already written numerous articles about the company. The copper production is going according to schedule and Nevsun has started to build the processing facility that will be needed to get the zinc out of the ore. In this article I will focus on the company’s newest greenfields discovery at the Mogoraib River license, a short drive from the central production facility at the Bisha main pit.

How will this impact Nevsun’s production profile?

As you already noticed, I’m quite excited about these exploration results as not only does it confirm the existence of several satellite deposits, it also indicates the mineralization is economical (the hole of 23 meters has a rock value of in excess of $250/t). On top of that, the assay results for 15 more holes are still pending, and if this type of grade could be confirmed over a decent strike length, then Nevsun might be sitting on a very valuable satellite deposit. [See above]

This won’t have an immediate impact on Nevsun’s production profile and any potential production from this zone is still several years out. However, this doesn’t mean investors and shareholders should just shrug their shoulders on this news. Not at all. Not only does this validate the exploration potential of the land package held by Nevsun Resources, as the new discovery is located just 12 miles away from the Bisha plant, it would be very easy to truck the ore from Asheli to the plant.It will be very interesting to determine the size of the mineralized zone as just like the Harena mineralization, Asheli has the potential to add several years to the useful mine life of the Bisha project.

Investment thesis

Shareholders of companies in the production phase usually don’t care at all about exploration results, but in Nevsun’s case they really should. Not only does it validate the prospectivity of the land package, there’s now a very realistic opportunity to re-think the mine plan at the Greater Bisha area as the mine life will undoubtedly be longer and the NPV higher than originally anticipated.Nevsun continues to generate a substantial amount of free cash flow which is currently being spent on the zinc plant and the regional exploration program. Even though the exploration expenditures aren’t very high, it’s worth every penny Nevsun is spending on it.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: