One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S05 E28): Tim Travis On Regional Banks, Financials, Value And The Tardigrade

In their latest episode of the VALUE: After Hours Podcast, Tim Travis, Jake Taylor, and Tobias Carlisle discuss: Housing Crisis Phenomena The Bull Case For Oil Buying Bonds In Commercial Banks And Offshore Drillers Opportunities In Real Estate REITs Insurance Companies Pulling Out Of Florida Selling Too Early Investing Lessons … Read More

What Is The Real Value Of Pfizer Inc (PFE) Using A Simple DCF

As part of a new series, each week we’re going to conduct a DCF on one of the companies in our screens. This week the stock is Pfizer Inc (PFE). We currently have the stock on an Acquirers Multiple of 6.60. The stock is currently priced at $35.64. Profile Pfizer … Read More

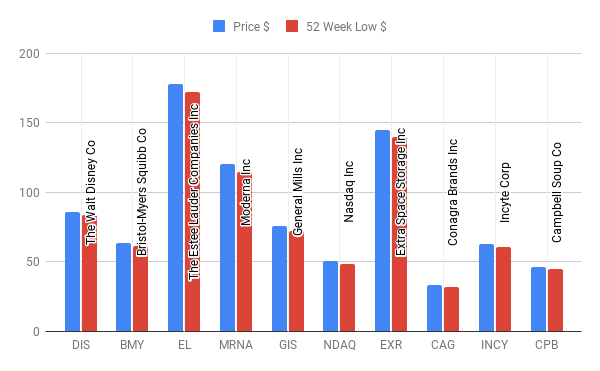

This Week’s 10 Big Named Companies Near 52 Week Lows

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ DIS The … Read More

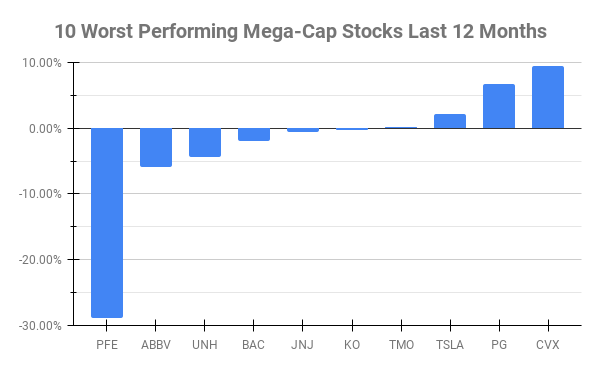

This Week’s 10 Worst Performing Mega-Cap Stocks Last 12 Months

Over the past twelve months ten Mega-Cap stocks have underperformed all others. Mega-Caps are defined by $200 Billion Market Cap or more. Here’s this week’s top 10 worst performing Mega-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) PFE Pfizer Inc -28.85% ABBV AbbVie Inc -5.95% … Read More

8 Book Recommendations By Joel Greenblatt

Joel Greenblatt is a successful American hedge fund manager. He is the Founder and Managing Partner at Gotham Capital. He has recommended a number of books that have influenced his thinking and approach to investing. While this list is by no means complete, here are some of the book recommendations … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (7/28/2023)

This week’s best investing news: David Einhorn – Value Investing: Down But Not Out? (Money Maze) Mohnish Pabrai – Founder & Managing Partner of Pabrai Investment Funds (IFA Global) An interview with Jamie Dimon, CEO at JP Morgan (IESE Business School) End of an Era? (Verdad) Tom Gayner, how are … Read More

Stock In Focus – TAM Stock Screener – Alphabet Inc (GOOGL)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Alphabet Inc (GOOGL) Alphabet is a holding company. Internet media giant … Read More

Uncertainty And The Precautionary Principle

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed Uncertainty And The Precautionary Principle. Here’s an excerpt from the episode: Jake: Hopefully, that you guys have been talking about something that might be somewhat tangentially related to the idea of uncertainty, because that’s what … Read More

Warren Buffett: You Have To Be Prepared To Grab Opportunities When They Come Around

During the 2010 Berkshire Hathaway Annual Meeting, Warren Buffett explained why you have to be prepared to grab opportunities when they come around. Here’s an excerpt from the meeting: WARREN BUFFETT: There will probably be fewer, but I would say there will always be — except in the most bubbly … Read More

Ian Cassel: How To Find 10 Baggers, 20 Baggers

During his recent interview with The Investor’s Podcast, Ian Cassel explains how to find 10 baggers, 20 baggers. Here’s an excerpt from the interview: Cassel: There aren’t many of them that exist, you know, and that’s why they trade where they do. And so that’s also an element of scarcity … Read More

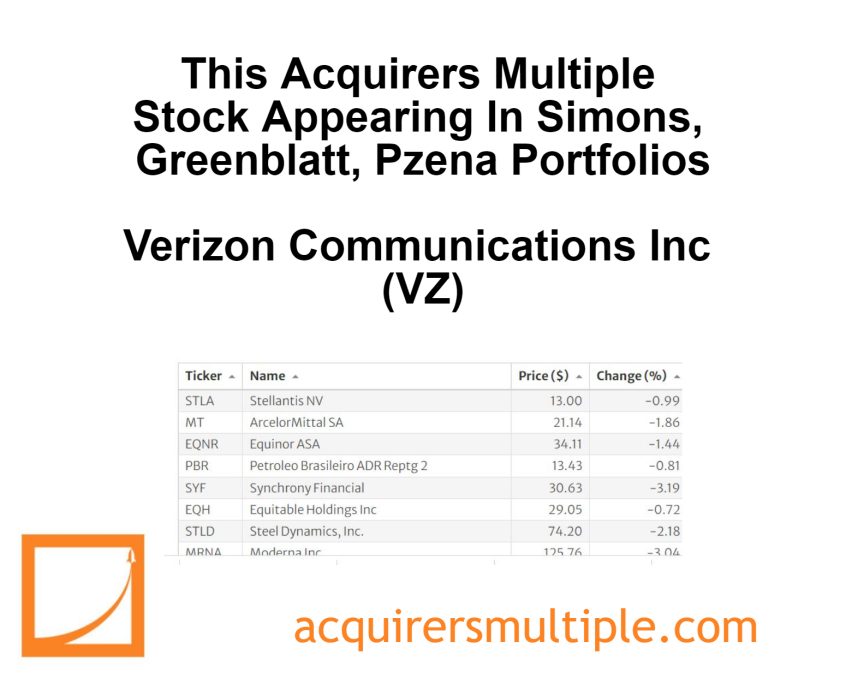

This Acquirers Multiple Stock Appearing In Simons, Greenblatt, Pzena Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Value Spread Closes – What It Means

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed Value Spread Closes – What It Means. Here’s an excerpt from the episode: Tobias: I know that everybody likes the value spread update. So, the value spread came crashing in from May to June, end … Read More

Michael Burry: Combining Technical Analysis With Value Investing

In his August 9, 2000 Journal Entry, Michael Burry explained how value investors can combine technical analysis with fundamental analysis. Here’s an excerpt from the entry: Burry: With the market rallying since just prior to the start of the Strategy Lab, I must admit that many of the stocks I … Read More

Warren Buffett: We Follow Phil Fisher’s Approach To Dividends

In his 2012 Berkshire Hathaway Annual Letter, Warren Buffett explained why he follows Phil Fisher’s approach to dividends. Here’s an excerpt from the letter: Buffett: Above all, dividend policy should always be clear, consistent and rational. A capricious policy will confuse owners and drive away would-be investors. Phil Fisher put … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

When Warren Buffett Saw The Terror Threat

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed When Warren Buffett Saw The Terror Threat. Here’s an excerpt from the episode: Tobias: I like those ideas. I get a few comments on that. Using that precautionary principle, he realized that he had too … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

David Einhorn: The Biggest Change To Value Investing Today

During his recent interview with The Money Maze Podcast, David Einhorn discusses the biggest change to value investing today. Here’s an excerpt from the interview: Einhorn: I would tend to have looked at things a long time ago, which is our business was buy things that are sort of cheap, … Read More

Howard Marks: The Future Is Unusually Murky, Unusually Uncertain

During his recent presentation at INSEAD’S IMC, Howard Marks explained why the future is unusually murky, unusually uncertain. Here’s an excerpt from the presentation: Marks: Each investor should have a notion for what is the right balance of aggressiveness and defensiveness for them. It’s a personal thing. It’s subjective, and … Read More