In his book Fooling Some of the People All of the Time, David Einhorn explains why he’s an absolute return investor, saying absolute return investors focus on the risk-reward trade-off of an investment, while relative return investors focus on outperforming a benchmark. Here’s an excerpt from the book: We consider … Read More

Warren Buffett: Cigar Butts and Low Returns on Equity: Time is the Enemy of Poor Businesses

During the 1998 Berkshire Hathaway Annual Meeting, Warren Buffett explained why he gave up his “cigar butt” approach to investing. Arguing that businesses with low returns on equity are not good investments, even if they are purchased cheaply, because time is the enemy of the poor business and the friend … Read More

VALUE: After Hours (S05 E38): WSJ’s Spencer Jakab on The Revolution That Wasn’t: GameStop and Reddit

In their latest episode of the VALUE: After Hours Podcast Jake Taylor, Tobias Carlisle, and Spencer Jakab discuss: GameStop Mania: What Went Wrong Investment Insights from Mimicry in the Natural World Proxy Statements: The Key to Honest Investment Signals Navigating the ‘Q’ Designation and ‘Greater Fool’ Theory in Investing Cash is King: … Read More

David Einhorn – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (10/20/2023)

This week’s best investing news: Ray Dalio – Risk, Return, and Asset Allocation (Value Investing with Legends) Superlinear Returns (Paul Graham) Warren Buffett Revealed To Be Quietly Making Bank From Bitcoin And Crypto Amid Price Swings (Forbes) Navigating the Magnificent Seven’s Fundamentals (Validea) Longtime stock-market bear Jeremy Grantham is probably … Read More

Why Meta Platforms Inc Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Meta Platforms Inc (META) Meta is the world’s largest online social … Read More

Operation Twist: Can It Help Equity Prices?

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and Brewster discussed Operation Twist: Can It Help Equity Prices?. Here’s an excerpt from the episode: Tobias: -in the 30-year bonds and all of the commercial credit has been amazing. I think Meb’s been posting about it a … Read More

Joel Greenblatt: The Pitfalls of Market-Cap-Weighting

In his book The Big Secret for the Small Investor, Joel Greenblatt explains how market-cap-weighting guarantees an imbalanced portfolio, favoring overpriced stocks and neglecting bargain-priced ones, regardless of whether one can identify specific mispriced stocks or not. Here’s an excerpt from the book: Remember, a market-cap-weighted index ends up having … Read More

Michael Burry: How to Outsmart the Market: Avoid ‘Upgrading’ Your Portfolio

In his 2001 Scion Letter, Michael Burry discusses how to outsmart the market by avoiding ‘upgrading’ your portfolio. Here’s an excerpt from the letter: Finally, I suspect that many who are actively upgrading their portfolios are doing so because they fear missing either a major market rally or the next … Read More

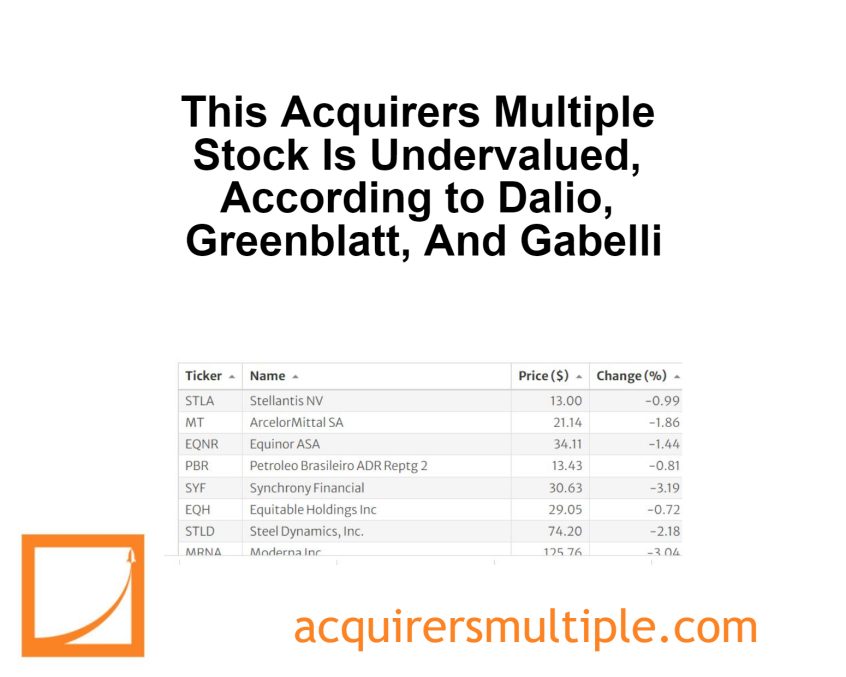

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Greenblatt, And Gabelli

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Contrarian Optimism: The Secret to Outperforming the Market

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and Brewster discussed Contrarian Optimism: The Secret to Outperforming the Market. Here’s an excerpt from the episode: Jake: Then Kevin’s last point, which is probably my favorite is that, he says that the market rewards optimism. And so, … Read More

Mohnish Pabrai: 7 Questions To Answer Before Entering The Stock Market Chakravyuh

In his book The Dhando Investor, Mohnish Pabrai provides seven questions that investors must answer before entering the stock market chakravyuh. Here’s an excerpt from the book: Abhimanyu’s dilemma on that 13th day of battle has close parallels to the decisions confronting equity investors every day. The decision to enter, … Read More

Seth Klarman: The Portfolio Liquidity Cycle Serves Two Important Purposes

In his book Margin of Safety Seth Klarman discusses portfolio liquidity. Portfolio liquidity is important, but it can be illusory, and investors should be aware of the correlation between liquidity and investment fashion. Here’s an excerpt from the book: In times of general market stability the liquidity of a security … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Logical Conclusion of Fundamental Analysis is a Hold Forever Period

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and Brewster discussed Logical Conclusion of Fundamental Analysis is a Hold Forever Period. Here’s an excerpt from the episode: Jake: Okay. Second item to note from Kevin’s paper is the logical conclusion of fundamental analysis is a hold … Read More

Warren Buffett: “Wonderful Assets” In An Inflationary Environment

During the 2011 Berkshire Hathaway Annual Meeting, Warren Buffett explained why the best asset to hold in an inflationary environment is a high return on tangible capital business that requires very little capital to grow, such as See’s or Coke. He calls these businesses “wonderful assets” because they can continue … Read More

Ray Dalio: How To Create a Hedge Fund Empire by Focusing on Return Streams

In this interview with Value Investing with Legends, Ray Dalio explains how his approach to investing is to focus on return streams rather than asset classes. He defines a return stream as “a decision rule that would produce return streams.” He then goes on to explain that he can construct … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Ben Graham Doesn’t Get Enough Credit For His Work On Quantitative Value Investing

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and Brewster discussed Ben Graham Doesn’t Get Enough Credit For His Work On Quantitative Value Investing. Here’s an excerpt from the episode: Jake: Yeah. So, Kevin, just to give some context for everyone else, Kevin’s a professor of … Read More

Warren Buffett: If At First You ‘Do’ Succeed, Quit Trying

In his 1991 Berkshire Hathaway Annual Letter, Warren Buffett uses the quote, “If at first you do succeed, quit trying.” It’s a tongue-in-cheek way of saying that once you find a great investment, you should hold on to it. This is because great businesses are rare and difficult to find. … Read More