As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Tesla’s Future: Beyond the Hype: A Look at Battery Tech and Infrastructure

During their recent episode, Taylor, Carlisle, and Katsenelson discussed Tesla’s Future: Beyond the Hype: A Look at Battery Tech and Infrastructure, here’s an excerpt from the episode: Tobias: Vitaliy, can we talk about Tesla for a little bit, because I know that you did a write up about Tesla. Tesla … Read More

Warren Buffett: The Role of Consumer Loyalty and Emotional Connections in Investing

During the 2018 Berkshire Hathaway Annual Meeting, Warren Buffett discusses the importance of investing in companies that create products that engender positive emotional responses (like getting a kiss for giving See’s Candy) versus negative ones. Using Apple’s ecosystem led by the iPhone as an example of such an investment. The … Read More

Bill Nygren: How To Avoid Value Traps

In this interview with John Rotonti, Bill Nygren defines a value trap as a company that looks cheap (low multiples) but won’t actually become more valuable over time, typically due to structural problems. To avoid these, Nygren’s firm requires analysts to project future growth and only buy stocks with strong … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

The Danger of One-Decision Stocks

During their latest episode of the VALUE: After Hours Podcast, Carlisle, Taylor, and Vitaliy Katsenelson discussed The Danger of One-Decision Stocks. Here’s an excerpt from the episode: Tobias: I was at an Easter lunch over the weekend, and one of the guys, they said, “I’ve traded three crypto cycles.” We’re … Read More

Cliff Asness: Today’s Market Is Less Efficient Than Ever Before

In this interview with Meb Faber, Cliff Asness argues that the market has become less efficient despite advancements in technology and information access. He believes the abundance of information can lead to overconfidence and create situations like the meme stock craze. He proposes that the ease of communication can turn … Read More

Ray Dalio: China Investing: A Proven Path to Success in Bull & Bear Markets

In his latest article titled ‘To Answer the Question of Why I Invest in China’, Ray Dalio explains why he invests in China: Experience and Success: He has a long history of successful investing in China, and believes his approach can handle both good and bad markets Love for China: … Read More

Michael Burry – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E14): Vitaliy Katsenelson on Soul In The Game, Value, Sideways Markets, $TSLA

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Vitaliy Katsenelson discuss: Don’t Be Fooled by Popularity: The Danger of One-Decision Stocks Tesla’s Future: Beyond the Hype? A Look at Battery Tech and Infrastructure How Social Media Creates a Global FOMO Frenzy Can Physics … Read More

Tesla Inc (TSLA) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Tesla Inc (TSLA). Profile Founded in 2003 and based … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (04/05/2024)

This week’s best investing news: Greenlight Capital’s David Einhorn shares investment ideas at the Sohn Conference (CNBC) Cliff Asness – Cognitive Dissonance (AQR) Lessons from Danny Kahneman | Investing in Practice Rather Than Theory (Validea) Warren Buffett-backed EV maker BYD surprises with stellar first quarter sales as Tesla continues to … Read More

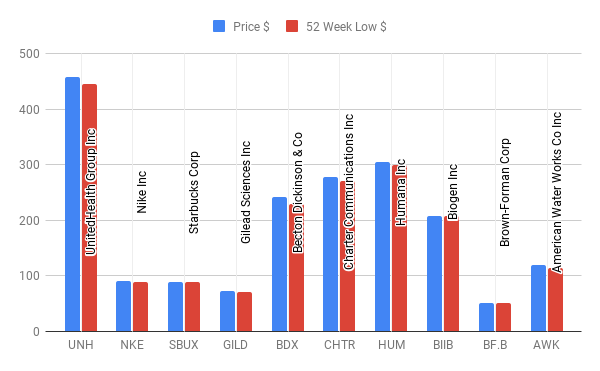

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ UNH UnitedHealth … Read More

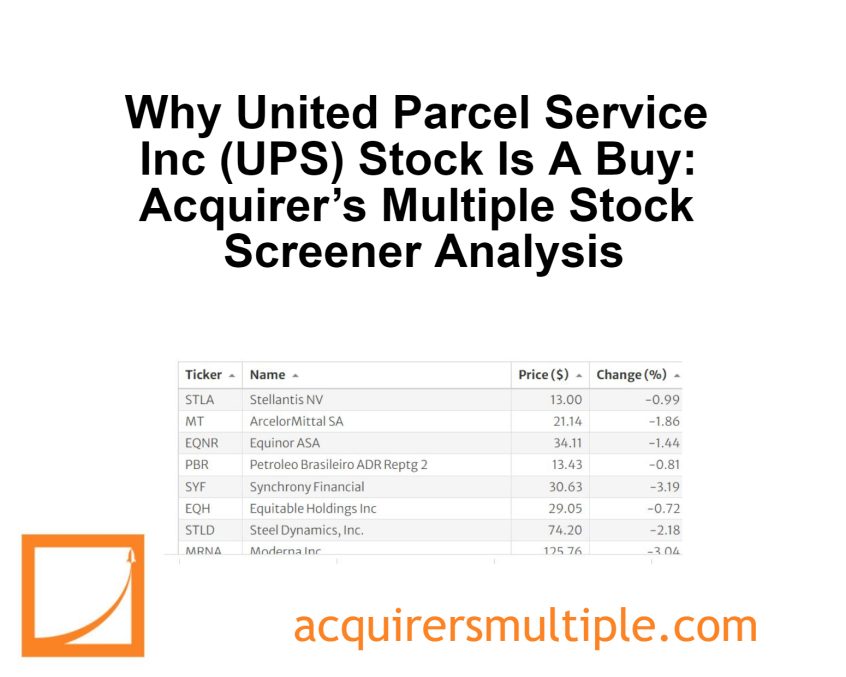

Why United Parcel Service Inc (UPS) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: United Parcel Service Inc (UPS) As the world’s largest parcel delivery … Read More

From Laplace’s Demon to AI Ethics: Biases, Surveillance, and the Limits of Control

During their latest episode of the VALUE: After Hours Podcast, Carlisle, Taylor, and Eric Cinnamond discussed From Laplace’s Demon to AI Ethics: Biases, Surveillance, and the Limits of Control. Here’s an excerpt from the episode: Jake: Shall we get some veggies- Tobias: You can say veggies. Jake: -under the wire … Read More

Warren Buffett: Inspired by Ben Graham: How I Learned to Love Falling Stock Prices

In his 2011 Berkshire Hathaway Annual Letter, Warren Buffett explained why investors who plan to buy stocks in the future should welcome falling stock prices (swoons) because it allows them to buy at a discount. However, most people feel happy when stock prices rise, even if they are net buyers. … Read More

David Einhorn: The Shift in Value Investing: Fewer Players, More Opportunities

In this interview with CNBC, David Einhorn says that the traditional value investing industry, where professionals managed funds and searched for undervalued stocks, has shrunk due to the shift to indexing. This means there’s less competition for value investors today, who can find more undervalued securities. Value investing itself remains … Read More

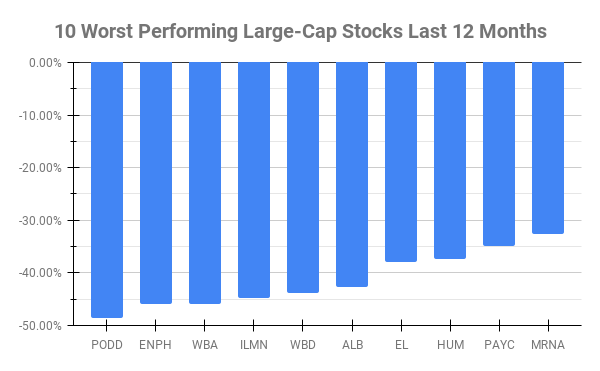

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) PODD Insulet Corp -48.52% ENPH Enphase Energy Inc … Read More

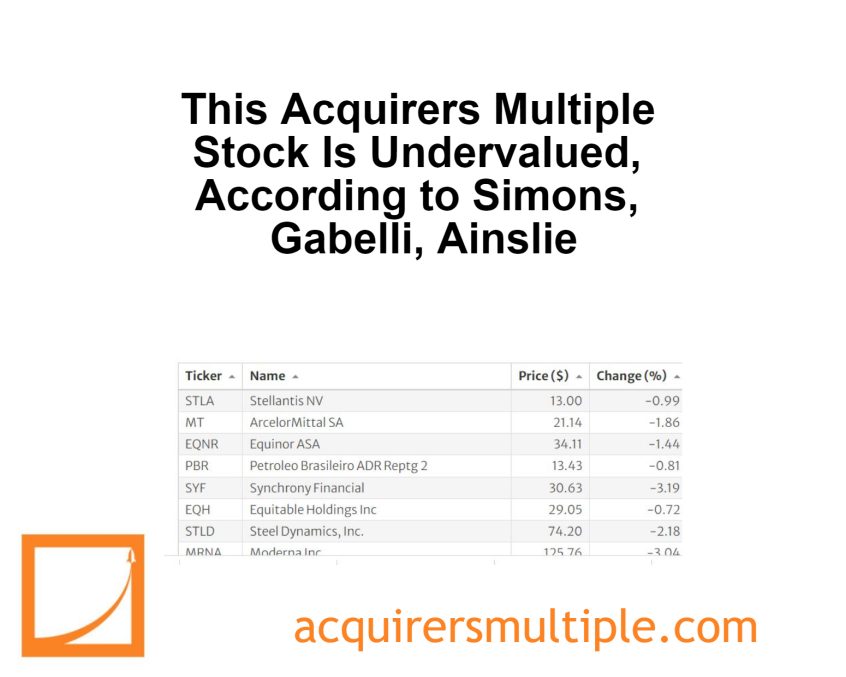

This Acquirers Multiple Stock Is Undervalued, According to Simons, Gabelli, Ainslie

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Can AI Ever Replace Experienced Investors?

During their latest episode of the VALUE: After Hours Podcast, Carlisle, Taylor, and Eric Cinnamond discussed Can AI Ever Replace Experienced Investors?. Here’s an excerpt from the episode: Jake: [laughs] Ah, ooh, boy. Eric, how well do you think a model could do if you gave it all of the … Read More