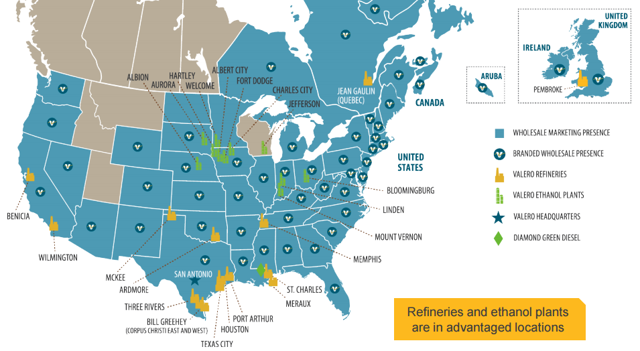

VLO was founded in 1955 and is based in San Antonio, Texas (It was formerly known as Valero Refining and Marketing Company and changed its name to Valero Energy Corporation in August 1997). It’s an independent petroleum refining and marketing company in the United States, Canada, the Caribbean, the United Kingdom, and Ireland. It operates through two segments, Refining and Ethanol. The Refining segment is involved in refining, wholesale marketing, product supply and distribution, and transportation operations. This segment produces conventional and premium gasolines, gasoline meeting the specifications of the California Air Resources Board (CARB), reformulated gasoline blendstock for oxygenate blending, diesel fuels, low-sulfur and ultra-low-sulfur diesel fuels, CARB diesel fuel, distillates, jet fuels, asphalts, petrochemicals, lubricants, and other refined products. The Ethanol segment produces and sells ethanol and distillers grains. The company markets its refined products through bulk and rack marketing network; and through approximately 7,400 outlets under the Valero, Diamond Shamrock, Shamrock, Ultramar, Beacon, Texaco, and other names. As of December 31, 2014, it owned 15 petroleum refineries with a combined throughput capacity of approximately 2.9 million barrels per day. Valero also owns and operates 11 ethanol plants with a combined ethanol production capacity of approximately 1.3 billion gallons per year.

This is an interesting take on Buffett’s interest in PSX and what it could mean for VLO from long/short equity, value investor David White.

Valero Energy Corp. has been a strong company for many years. The stock has risen roughly 300% over the last five years; and its trailing twelve month PE is still only 7.06.The picture below shows the locations of its refineries, etc.

Since the US is producing more light sweet crude (about 9.5 million bpd in 2015) than it has in the recent past, one might think VLO’s higher complexity abilities might be useless. However, this is not true. The Canadian oil sands crude is heavy sour crude. Much of the crude from Iran, Iraq, and Saudi Arabia (and others) is heavy sour crude. In addition the US may be on the verge of allowing exports of US crude oil for the first time in a long time. These things would mean that VLO could do very well for itself by processing heavy sour crude from the above locations, while paying less than the WTI light sweet crude price. This would put VLO in the “catbird seat”; and it appears that this is exactly what will eventually happen.

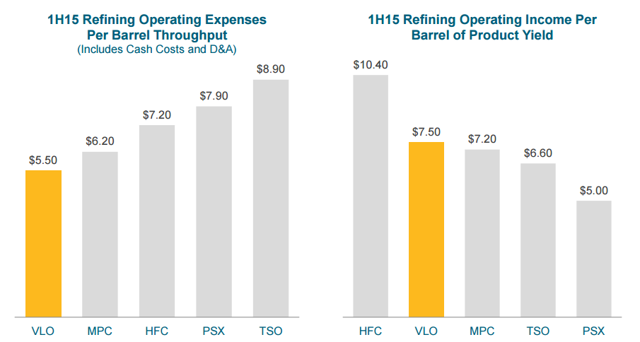

As investors can see VLO’s operating costs are already the lowest among its peers; and VLO’s Operating Income per barrel is nearly the highest among its peers. The new Enbridge pipeline project due to be completed in Q4 2015 should improve VLO’s results further.

One should consider the Keystone XL pipeline too. The southern and the northern parts of this have already been built. The middle section would allow about 830,000 bpd of Canadian Oil Sands crude (heavy sour crude) to move from Alberta to the US Gulf Coast. The remaining piece of this pipeline got Congressional approval in 2015; but it was vetoed by President Obama. Still Obama will be out of office in less than 1.5 years. The State Department study to evaluate whether the Keystone XL pipeline was in the best interest of the US should be done before that. The study is the excuse Obama used for vetoing the bill. The Senate didn’t have enough votes to override Obama’s veto; but Congress is sure to propose another bill as soon as the State Department study is done. Virtually everyone thinks this study will find that the Keystone XL pipeline is in the long term best interest of the US. If the US sees a recession in 2016, that too could push Congress and Obama to gain approval for a pipeline that will also create a lot of new jobs (42,000 in one estimate). A lot more heavy sour Canadian Oil Sands Crude being able to reach Texas could only help high complexity refiner VLO. VLO should then be able to demand still lower Arabian heavy sour crude prices. It should be able to use less WTI light sweet crude (more expensive than sour heavy crude). This should lead to more profitability for VLO.

Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) (“Warren Buffett”) recently bought another 3.51 million shares in Phillips 66 (NYSE:PSX). This brings its total to 61.5 million shares — 11.4% ownership. Many consider VLO to be an even better company. If Warren Buffett is buying Phillips 66 , then some investors may wish to consider buying VLO.

VLO had a good to great Q2 2015. EPS were $2.66 per share compared to $1.22 per share in Q2 2014. Refineries operated at 96% capacity. Plus it guided for a payout ratio of 75% of FY2015 Net Income. VLO returned $870 million in cash to shareholders in Q2 2015. $203 million was in dividend payments; and $667 million was used to repurchase 11.3 million shares of VLO stock. This made the total payout ratio for 1H 2015 61% of Net Income. If VLO is going to reach its “declared” 75% of Net Income payout target for FY2015, it will have to increase its payouts for 2H 2015 substantially from those of 1H 2015. This should help the stock price.

White on the company’s fundamentals:

For VLO the fundamentals are good. It does not have overly much debt with a Total Debt/Total Capital (MRQ) of 25.04%, a Quick Ratio of 1.20x, and an Interest Coverage of 28.29x. By comparison, Phillips 66 , the stock that Warren Buffet is buying for Berkshire Hathaway (BRK-B), has a Total Debt/Total Capital (MRQ) of 27.85%, a Quick Ratio of 1.23x, and an Interest Coverage of –. VLO has $5.76B in total cash, $7.35B in total debt, Operating Cash Flow (“ttm”) of $6.62B, and Levered Free Cash Flow (“ttm”) of $3.93B. By comparison PSX has $5.09B in total cash, $8.96B in total debt, Operating Cash Flow (“ttm”) of $4.08B, and Levered Free Cash Flow (“ttm”) of -$2.22B. In other words, VLO appears to be in better fiscal condition than PSX.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: