Big changes in the composition of the screeners this week, giving us lots of exciting new stocks to dig into. While the indexes only declined a few points, under the surface the waters are roiling, with big declines from many stocks. Earnings season has also shaken up the fundamental picture. AU Optronics Corp. (AUO), for example, now the cheapest stock in the Large Cap Screener, is off 45 percent over the last two months. LG Display Co Ltd. (ADR) (LPL), the second cheapest stock in the Large Cap Screener is off 40 percent over the last six months.

Perion Network Ltd. (NASDAQ:PERI) is a new entrant into the All Investable Screener. At its $2.74 price at the time of writing, it has a market capitalization of $189 million. Net cash to the tune of $83 million puts it on an enterprise value of just $106 million, against which it has generated operating earnings of $79 million, making for a tiny 1.35x acquirer’s multiple.

The company, headquartered in Holon, Israel, provides online publishers and app developers various data-driven solutions to monetize and promote their application or content. It offers Perion Codefuel, a software monetization platform that allows digital businesses to optimize installs and analyze data; and Grow Mobile, an app promotion platform for mobile advertising, which enable advertisers of mobile applications to buy, track, optimize, and scale user acquisition campaigns from a single dashboard.

The company also provides consumer applications, such as IncrediMail, a unified messaging application that allows consumers to manage multiple email accounts and Facebook messages in one place; and Smilebox, an Internet photo sharing service for desktops and smart-phones, as well as offers Violet, a do-it-yourself wedding design tool.

The stock has been crushed–down almost 30 percent over the last three months–because the company is transitioning to a new business model, and the revenue run rate and operating earnings is likely to drop in the short term. Management have stated on the most recent earnings call that the company will return to growth by year end.

By year end, our monetization business will have returned to revenue growth, and, having completed a year of transition to our new revenue model, its profit margins will stabilize at a very healthy level. This business will continue to deliver strong cash flows that we intend to invest back into the business to fuel future growth.

The company is cheap on any number of metrics, trading on a PE of 5.4 and a FCF/EV yield of 53 percent. With its huge cash pile and ongoing cash generation, management should consider a buyback, but the company has tended to be a net issuer, and management have been slow to embrace the idea, arguing for–blurgh–acquisitions:

Our cash balance continues to grow, reflecting the strong free cash generation of our business, and stands at approximately $128 million at quarter end. I know many investors have enquired about a share buyback and given our current stock price, it is something we have and are considering. We also feel we have a strong pipeline of M&A opportunities and continue to weigh all options to deploy our cash in a manner that best increases long term shareholder value.

PERI appears attractively priced on a valuation basis

This punishment of the stock has created what I believe to be a good entry point allowing one to own shares of a company that not only is still profitable but is selling at attractive multiples:

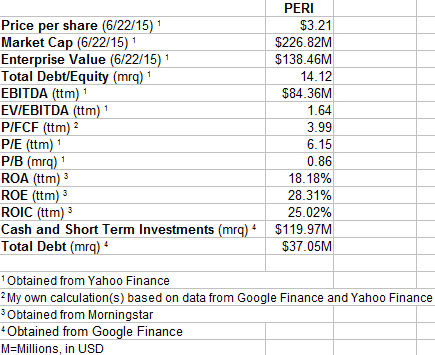

Source: Data obtained from Yahoo Finance, Google Finance and Morningstar

As one can see, PERI looks very undervalued in regard to every metric displayed above. In addition, looking at the balance sheet reveals that PERI currently has almost $120 million in cash and short-term investments. In comparison, its total debt is only about $37 million. This is mainly why its enterprise value is less than its market cap. This is a very important point as this cash gives management the ability to make acquisitions to further its evolution toward a more mobile-centric tech company, something they have been doing recently.

…

PERI has been hit hard over the last year due to declining revenue and concerns regarding its business model. While these concerns may be somewhat justified, I believe the market is being overly pessimistic in its assumptions and is pricing PERI much too low. PERI has low debt, low valuation multiples, almost $120 million in cash, and it’s increasingly focused on mobile advertising which could very well provide substantial growth for PERI in the coming years. In a market that one could argue is overvalued, PERI appears to be one of the few companies that’s anything but.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “Perion Network Ltd. ($PERI): Cheap, cash rich, and generating cash”

Pingback: Johnny’s Real-Life Acquirers Multiple Portfolio – (Month 3 – Feb 2016) | Stock Screener - The Acquirer's Multiple®