Humana Inc (NYSE:HUM), one of my very long-term portfolio holdings is seeking a sale.

Humana, one of the country’s largest health insurers, is weighing a potential sale of itself after having been approached by several competitors, people briefed on the matter said on Friday.

…

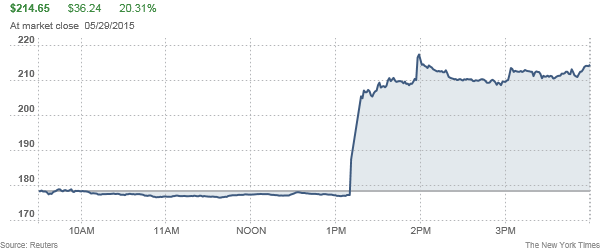

Any deal for Humana would be expensive: The insurer had a market value of about $27 billion before The Wall Street Journal reported on the company’s deliberations. Humana’s shares jumped 20 percent, closing on Friday at $214.65.

Source: Humana Is Said to Consider Sale of Company – NYTimes.com

Whether it catches a bid or not, it looks likely to be rebalanced out of my portfolio at the end of the quarter. It’s a sad day for me. I’ve held it since April 2010, and I’d be more than happy to keep holding it. While HUM had plenty of good years in the intervening period, it remained consistently the cheapest or second cheapest stock in my primordial version of the Large Cap 1000 screen, and so I kept holding it. A great first quarter and the announcement about chance of sale this week means that it has run away from the screen, and it time to say goodbye.

Fortunately, there are plenty of good candidates in the Large Cap 1000 screen. It looks likely to be replaced by Fiat Chrysler Automobiles NV (NYSE:FCAU).

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “Humana Inc (NYSE:HUM) seeks a bid, and exits the screen; Up 20+ percent for the week”

Hi Tobias,

Question for you. When you screen these stocks, my understanding is that you exclude the financial sector (in addition to utilities). Many insurance companies are considered part thereof, but health insurers are not since they’re classified under Health Care->Health Care Equipment and Services->Health Care Providers and Services->Managed Health Care.

When doing my own screens and backtests using the acquirer’s multiple, health insurance companies keep rising to the top of the ranks (Humana, Well-point and Anthem being regulars). I’ve since removed the “Managed Health Care” sub-industry from my results. I’m curious about your reasoning for allowing them to remain and how you perceive them differently from other financial stocks. It’s not a criticism, but I’m curious what I’m missing here.

Thanks for the great books and site.