Updated November 29, 2017

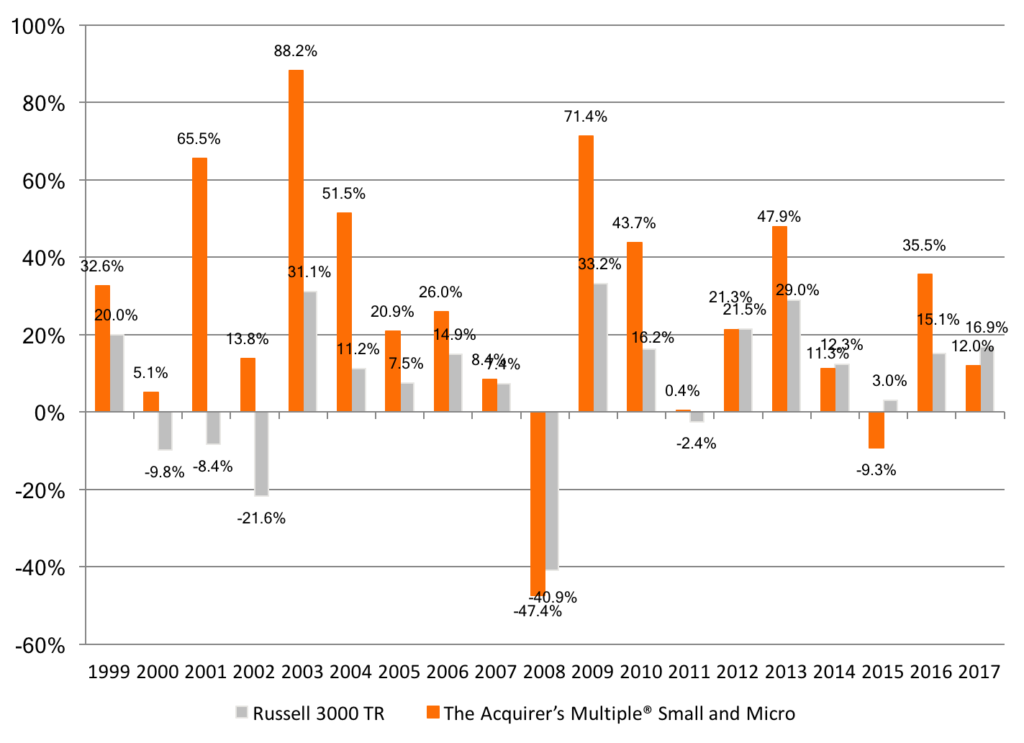

Since the last update in July 26, 2016, the screen had a strong finish to end the 2016 year up 35.5 percent, handily beating out the Russell 3000’s 12.2 percent by 20.4 percent.

2017 to date has been weaker. For the year, the Small and Micro Screen gained 12.0 percent, underperforming the Russell 3000’s strong 16.9 percent by a -4.9 percent.

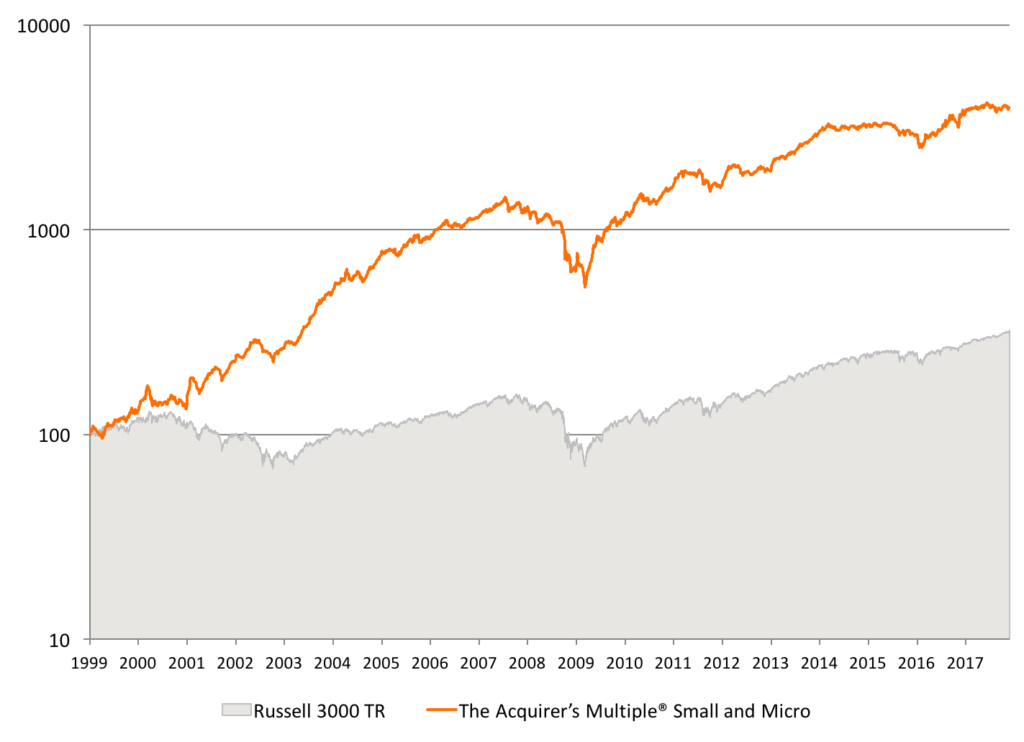

Chart 1. Returns from January 2, 1999 to Date (Log.)

We backtested the returns to a theoretical portfolio of stocks selected by The Acquirer’s Multiple® from the Small and Micro Cap screen. The backtest assumed the portfolio bought and held for a year 30 stocks selected from the small and micro cap universe (the smallest half of stocks by market capitalization). The model portfolios were rebalanced on the first day of the year using the most recent fundamental data. The screen excluded stocks traded over-the-counter (OTC). The backtest ran from January 2, 1999 to date.

Over the full period, the screens generated a total return of 3,948 percent, or a compound growth rate (CAGR) of 21.5 percent per year. This compared favorably with the Russell 3000 TR, which returned a cumulative total of 321 percent, or 6.4 percent compound.

Chart 2. Yearly Returns from January 2, 1999 to Date

On an yearly basis, the model portfolios selected by The Acquirer’s Multiple® generally outperformed, although underperformed in 2008 (-6.5 percent), 2012 (-0.3 percent), 2014 (-1.0 percent), 2015 (-12.3 percent) and 2017 to date (-4.9 percent).

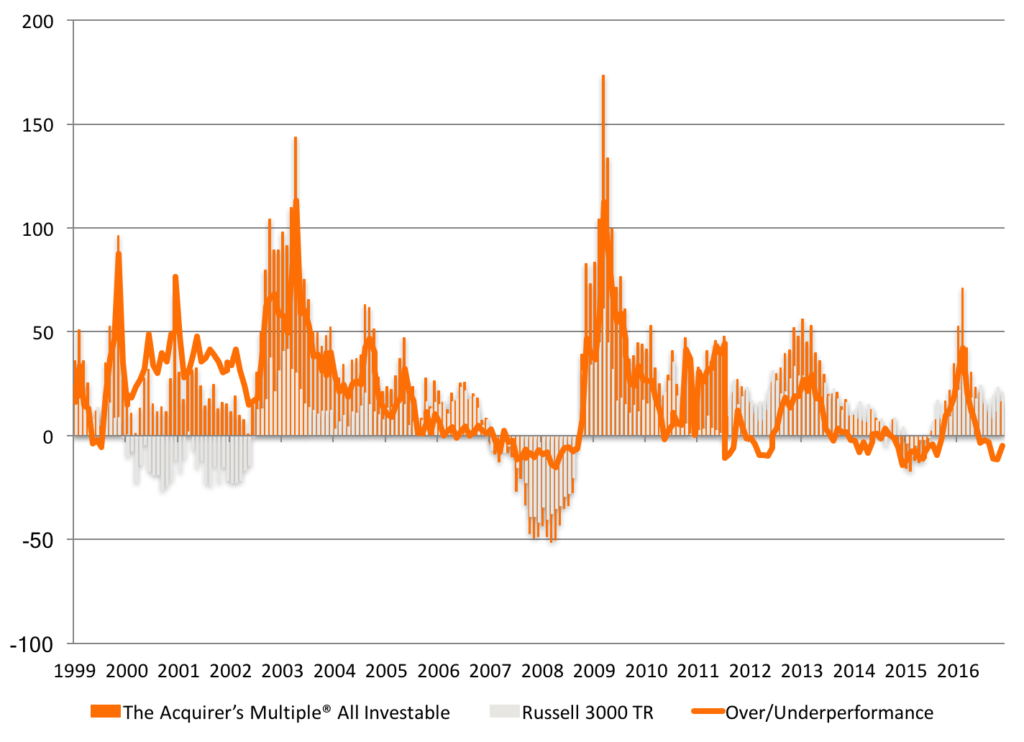

Chart 3. Rolling Yearly Returns from January 2, 1999 to Date

The average twelve-month return for any stock selected by The Acquirer’s Multiple® Small and Micro Cap screen was 25.8 percent, beating out the Russell 3000’s average stock at 7.6 percent by 19.2 percent.

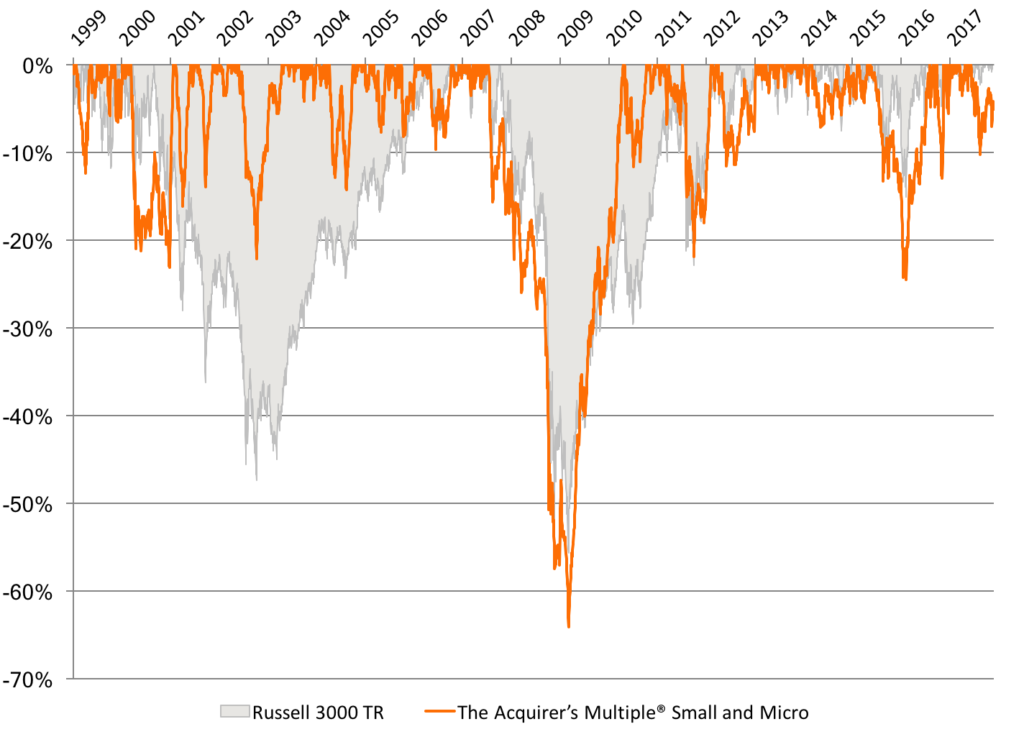

Chart 4. Drawdowns from January 2, 1999 to Date

The worst drawdown for The Acquirer’s Multiple® screens was -64 percent, which occurred between July 2007 and March 2009. Over the same period, the Russell 3000 TR drew down -56 percent.

The 30-stock model portfolios selected by The Acquirer’s Multiple® from the Small and Micro Cap universe consistently outperformed the broader, and larger capitalization Russell 3000 TR. The trade off is periodic underperformance–approximately one in five years–and deeper drawdowns.

Disclaimer: Backtested performance does not represent actual performance and should not be interpreted as an indication of such performance. Actual performance may be materially lower than that of the backtested portfolios. Backtested performance results have certain inherent limitations. Such results do not represent the impact that material economic and market factors might have on an investor’s decision-making process if the investor was actually managing money. Backtested performance also differs from actual performance because it is achieved through the retroactive application of model portfolios (in this case, The Acquirer’s Multiple®) designed with the benefit of hindsight. As a result, the models theoretically may be changed from time to time and the effect on performance results could be either favorable or unfavorable.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

10 Comments on “Small and Micro Cap Stock Screen Backtest”

So 1000 invested would turn into 18 750?

Well, ignoring tax and trading costs, $1000 turned into $34,440*.

*The disclaimer about backtested performance applies.

Great ideas. Are there any ETFs (or funds) that do similar strategies?

Yep. I’ll have one soon enough.

Hi Tobias,

I am considering subscribing, but was wondering how you respond to the argument that the excess returns of the small and micro-cap back tests are largely illusory given that they exclude trading costs? For instance, some studies appear to show that the round trip trading cost (including price impact) averages between 17%-27% for the smallest companies!

For instance, how would you estimate trading costs as a function of position size relative to some metric like the stock’s daily average dollar value traded?

Thanks!

Sam

The spread between bid and ask is the issue. The backtests use the day’s average trading price. It may reduce the returns of the small and micro backtests if you need to trade your entire position in one day but you should be fine if you’re patient and use limit orders. If you’re concerned the returns won’t be available in the small and micro, use the All Investable screener. Those are much larger stocks and should be tradable for individuals and most small funds. I’ve included the backtests for the small and micro to demonstrate that they are in the same magnitude as the All Investable.

Thinking of starting a subscription, however one question:

Do you have any idea on how the performance would have been if adding a momentum factor?

Meaning instead of choosing the cheapest 30 stocks from the small and micro cap universe, you for example choose the 60 cheapeest stocks, and then pick half of the stocks with the best momentum (30 in total), and rebalance annually as usual.

I assume this would have increased the performence further as “Value then momentum” in general beats only “Value”.

Momentum can help. It can also hurt. Both work over the long term but work at different times.

Tobias,

I loved the book! Great and quick read. I also enjoy listening to several podcasts you’re on. You talk about the golden rule of models and modelling, but you also seem to imply on several podcasts you’re more of the business investor vice a quant investor (maybe I’m wrong). I also would like to be a business investor, but don’t want to fall into the pit trap of thinking I’m smarter than the golden rule. Is there any advice on how to avoid low hanging traps for the business investor vice just following a quant style portfolio? So for example, one hypothesis (untested) of mine would be that making business picks and staying with them for a while (say at least a year) vs trading more often would probably help. I just don’t know if I would fall into the problem of seeing too many “broken legs” even when they are fake. Any thoughts?

I have a disciplined process that includes reviewing the MD&A and other footnotes. Details here: http://acquirersfunds.com/